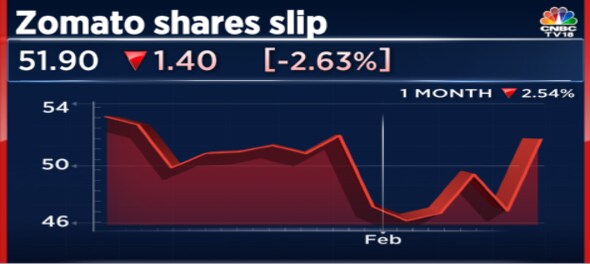

Shares of Zomato slipped over 2 percent on Monday, days after the food delivery company reported a net loss of Rs 346.6 crore for the December quarter of FY23 against a net loss of Rs 63.2 crore in the same period last year.

Moreover, the EBITDA loss declined to Rs 366.2 crore in the third quarter of this fiscal from Rs 488.8 crore in the corresponding period in the previous fiscal. Also, total income stood at Rs 1,948.2 crore, up 75.2 percent against Rs 1,112 crore in the corresponding period.

Here is what brokerage houses think of the stock:

| Brokerage house | Call | Target price |

| JPMorgan | Buy | Rs 100 per share |

| Nomura | Reduce | Reduced to Rs 45 per share |

| Morgan Stanley | Overweight | Rs 82 per share |

Morgan Stanley noted that Zomato's management had said that the slowdown in gross order value (GOV) was due to macro factors rather than due to any major market share shift. The brokerage also added that there are early signs of improving engagement levels and that visibility is there on profitability levers for break-even.

JPMorgan said that Zomato's focus is on a higher frequency. As per the brokerage firm, take rates can go up and BlinkIT can "surprise positively". JPMorgan added that overall take rates will be led by advertisement monetisation as restaurants drive platform growth. In e-commerce, take rate means the fee charged by a marketplace for transactions it facilitates on its platform.

Nomura said that the slowdown in the food delivery business was higher than expected and that initiatives to revive growth would delay a continued recovery in the contribution margin. The brokerage believes that Zomato's food delivery business and Zomato Gold would spur growth but slow down the company's improvement.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM