Domestic brokerage Yes Securities has made changes to its model portfolio for investors. The brokerage has added ICICI Bank and CAMS to its portfolio while removing Reliance Industries PP and Tata Consumer Products and booked profits.

ICICI Bank has 4 percent weight in the portfolio and CAMS has 3 percent weight. Tata Consumer Products had 3.1 percent weight in the portfolio while Reliance Industries PP formed 0.7 percent of the portfolio.

Here is the rationale behind the new additions

ICICI Bank:

Yes Securities believes that the bank's current COVID provisioning buffer (1.3% of loans, apart from the cushion of 79% PCR) should be adequate to address the requirement for restructuring and residual NPL flow.

Besides regularization of credit cost, recovery in NIM (coming back to maintaining usual balance sheet liquidity), acceleration in loan growth and retention of cost reductions would drive sizeable profitability improvement in the coming years.

Core bank trades at 1.9x FY22 P/ABV, and should continue to re-rate on the back of strength in the balance sheet (low-risk portfolio in this cycle + high capitalization), it said.

CAMS:

Yes Securities expects steady market share gains for CAMS and the operating leverage to aid margin expansion. It noted that the company is diversifying its revenues.

The brokerage house believes that CAMS is a proxy on AMC’s AUM growth in India. It is cash-rich, 35%+ RoE, 65%+ dividend payout, deserves premium valuation, it said.

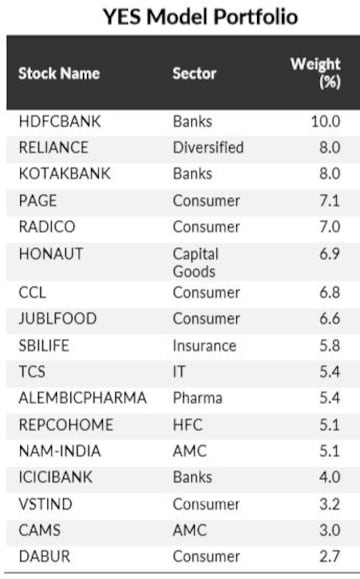

Here is the model portfolio of Yes Securities:

(Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.)

(Edited by : Abhishek Jha)

First Published: Dec 14, 2020 2:07 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 35% voter turnout recorded by 1 pm

Apr 26, 2024 9:11 AM