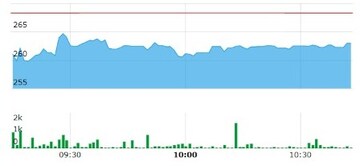

Shares of Wockhardt fell as much as 5.29 percent to Rs 254.2 in early trade as investors reacted to the company’s losses widening to Rs 311 crore in the March quarter on a year-on-year (YoY) basis.

At 10:48 am, the stock was trading at Rs 262.55 apiece on the BSE, down 2.18 percent, having pared off some of its initial losses. The shares of the Mumbai-based global pharmaceutical and biotechnology company have fallen after three consecutive days of gains and have underperformed the sector by 1.87 percent.

Wockhardt intraday stock chart (source: BSE)

In the past year, the stock underperformed Sensex by over 67 percent.

The company’s loss widened in the fourth quarter of FY22, however, its revenue saw a marginal increase. In the March quarter, Wockhardt’s India business revenue stood at Rs 174 crore, accounting for 27 percent of the global business revenue.

| Q4FY22 | Q4FY21 |

| Loss | Rs 311 crore | Rs 107 crore |

| Revenue | Rs 655 crore | Rs 632 crore |

| EBITDA Loss | Rs 33 crore | Rs 66 crore |

“What is remarkable for the quarter is our India businesses grew by 45 percent and it grew by 55 percent for the year. It now contributes something of the order of 27 percent of our total business,” Habil F Khorakiwala, chairman of Wockhardt, said in an interview to CNBC-TV18.

The firm's UK business clocked in revenue of Rs 205 crore, while that of emerging markets stood at around Rs 157 crore. The company’s US business was impacted by price erosion and supply disruptions with revenue in the quarter standing at Rs 59 crore, down from Rs 95 crore in the fourth quarter of FY21.

Khorakiwala said, “Emerging market also grew by 29 percent. So, we see very strong growth in India and emerging market. Our UK business because of a vaccine grew significantly and it contributes (UK and EU put together) 50 percent plus. However, our US business in the quarter declined from 15 percent of our total revenue to 9 percent.”

The chairman believes the company may end its loss-making run and breakeven (no profit, no loss) in FY23.

“We will certainly break even and generate surplus EBITDA (earnings before interest, tax, depreciation and amortization) as far as FY23 is concerned. We hope that we might break even in net profit in FY23. That is what we are planning for because our India business is very robust, our emerging market is robust and they have a decent margin,” he said

First Published: May 31, 2022 12:30 PM IST

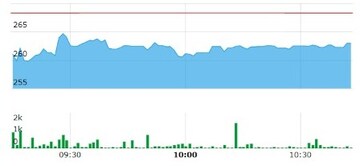

Wockhardt intraday stock chart (source: BSE)

Wockhardt intraday stock chart (source: BSE)