A state-run oil & gas company's stock has nearly doubled investors' money in the past 12 months. Its return exceeds that of the headline Nifty50 index by nearly five times.

The stock of state-run hydrocarbon exploration and production company Oil India Ltd (OIL) has also outperformed the public sector enterprise basket.

G Chokkalingam, Founder and MD at Equinomics Research, told CNBC-TV18 he is tracking the PSU since 1992. In his view, the PSU basket provides a 'phenomenal multibagger opportunity" once every 5-8 years.

Value investor Chokkalingam said the stock is still some 50 percent away from the peak of 3-4 years, despite having jumped 100 percent from the bottom.

Giving the rationale behind his bullishness on the stock, he said:

EXPLAINED

Besides, Oil India has a stake of about 69 percent in Assam's Numaligarh Refinery Limited (NRL), which is expanding its capacity by three-time to nine million tonnes, he said. "The financial closure also has happened already and the stock is trading only at a 5 PE despite the benefit of the oil theme," he said.

Chokkalingam believes that global oil prices can even touch the $100 per barrel quite soon. He sees Oil India as a defensive bet in case of a further fall in the market. "One may try to get the benefit out of rising oil prices through Oil India," he said.

The company's recently generated cash will also come in handy for rewarding shareholders, he said, recommending a 'strong buy' on the stock.

As of Monday's closing price, it is still about 19 percent away from a 52-week high of Rs 267.7, touched in October 2021.

Here's how the PSU stock has performed in the past year:

| Stock/index | Return (%) |

| Nifty50 | 20.4 |

| Nifty PSE | 42.8 |

| Nifty CPSE | 49.2 |

| Oil India | 94.3 |

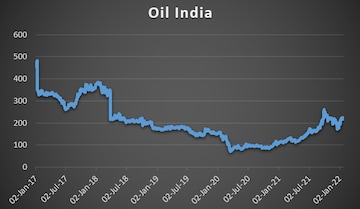

Here's how Oil India shares have fared in the past five years:

New age bet

Chokkalingam belongs to the club of market experts sceptical on new-age company stocks.

Speaking on Zomato, he said: "I may be wrong but I don't find the value in this stock. Unless that is a critical profit growth in the next two years and the PE shrinks significantly, I will not touch this kind of stock."

His remarks come at a time when new age business stocks in India are mirroring the trend on the Nasdaq, where investors have lost appetite for highly valued tech companies.

EXPLAINED: Why investors are dumping new age co stocks

(Edited by : Akanksha Upadhyay)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM