Deven Choksey, managing director (MD) of DRChoksey Finserv is cautious on Bharti Airtel despite strong fundamentals. The portfolio manager with an AUM (assets under management) worth nearly ₹480 crore believes that the telco’s stock price may not see any significant upward movement in the near term as the market has already factored in positives.

“I would think that the company would remain strong going forward from a performance point of view. However, as far as the stock price is concerned, I see most of the things are already priced into the current price of the stock," Choksey told CNBC-TV18 on November 1.

Choksey suggested that the market has already factored in positive expectations for Bharti Airtel, making it less likely to see significant upward movement in the near term. He also emphasized that opportunities might arise in a falling market.

His stance came a day after Bharti Airtel reported its second-quarter earnings, wherein the telco’s consolidated net profit dropped 37.5% year-on-year to ₹1,341 crore. It had reported a net profit of ₹2,145 crore a year ago in the same period.

More importantly, Bharti Airtel’s mobile average revenue per user (ARPU) increased to ₹203 in Q2 2024 against ₹190 in Q2 2023.

While Bharti Airtel’s 7.7 million 4G/5G net subscriber addition impressed brokerages, the Street punished the telco with its scrip falling more than a percent on Wednesday. However, buying on Thursday helped the stock settle with more than a percent’s gain at Rs 924.

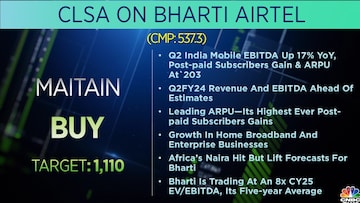

Among major brokerages, CLSA has maintained a 'buy' rating on Bharti Airtel with a target of ₹1,110 per share. It says the company witnessed growth in home broadband and enterprise businesses.

Jefferies issued a ‘buy’ call on Bharti Airtel stock, with a target price of Rs 1,085 per share, on its continued encouraging performance in Q2 and higher postpaid/4G subscriber additions. Domestic brokerage Motilal Oswal also gave a ‘buy’ rating to Bharti Airtel stock. Goldman Sachs also raised the target with a buy rating, while UBS retained a neutral rating.

Among major brokerages, JP Morgan maintained an underweight rating with a target price of Rs 785. It said they don't expect any tariff hikes in calendar year 2023 and concluded that Bharti may not be able to monetise its significant 5G investments over the next three years, as per telecomtalk.info.

The Telecom Regulatory Authority of India (TRAI) data released last month showed Reliance Jio gaining about 4 million subscribers, beating Airtel, which garnered about 1.5 million subscribers during the same period.

Note To Readers

Disclosure: Reliance Industries Ltd, which owns Jio, is the sole beneficiary of Independent Media Trust that controls Network18, the parent company of CNBCTV18.com.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM