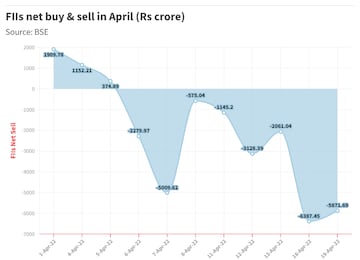

Foreign institutional investors (FIIs) have dumped Indian shares worth Rs 23,021.52 crore on a net basis so far this month, with the sell-off in the last two trading sessions particularly sharper. In the last eight consecutive sessions, including Tuesday's, FIIs have sold a total of Rs 26,458.4 crore from Indian shares. The sell-off sentiment in the last two trading sessions has cost investors about Rs 6 lakh crore.

So, what's triggering the FII sell-off in the Indian markets? Market experts see premium valuations of Indian shares compared to other Asian markets, especially China, amid inflationary pressures in an uncertain geopolitical milieu among key factors contributing to the exodus.

Not mincing words, Manpreet Gill, senior investment strategist at Standard Chartered Bank, believes India is at disadvantage compared to Asian peers, especially China when it comes to valuations.

“When it comes to Indian markets, our view is, from a regional perspective, a bit more neutral. I mean, (we were) overweight on India last year but today we are looking from a relative perspective, at least more than outperformance relative Asia potentially coming from markets like China, where valuations are far more bombed out,” Gill told CNBC-TV18 on Monday.

Besides valuation concerns, inflation woes continue to dampen street sentiments.

Adrian Lim, Asian Equities — Investment Director at Aberdeen, said that inflationary pressures are building up in India and other developing Asian markets and it is difficult to remain bullish on all sectors amid macro headwinds.

"I think investors need to be very careful about what they invest in here. Currently, when you look at developed markets and emerging markets, there are some top-down calls that are not unique to India alone, inflationary pressures are building across the region, not just in India, not just in Asian emerging markets as well, it's also emerging in Asian developed markets," Lim told CNBC-TV18 on Tuesday.

In India's case, the higher cost of buying crude oil raises the country's import bill and adds to the inflationary burden. In fact, the consumer inflation for the month of March has jumped to nearly 7 percent, almost a percent above the Reserve Bank of India's comfort level of 6 percent, which will likely force the monetary policy regulator's hand to raise benchmark interest rates to tame inflation.

Likewise, India's wholesale inflation — measured by the Wholesale Price Index (WPI) — worsened to 14.55 percent in March, the highest in four months. Inflation in the fuel and power category worsened to 34.52 percent in March from 31.50 percent in the previous month.

Crude oil prices remained in triple-digit dollars per barrel, with benchmark Brent futures hovering around the $113 a barrel mark on Tuesday.

Mark Matthews of Bank Julius Baer and Co, however, sees signs of demand waning for crude oil.

"If oil was going back to $130 per barrel, I would be concerned, but I do not think it is. I think that we are already seeing signs of demand destruction, which obviously is bad for economic growth globally," Matthews told CNBC-TV18.

On emerging markets, he said, "They (EMs) do not like the strong dollar and we are facing a strong dollar now because the cost of debt goes up for them, their currencies go down and typically they do not like high commodity prices either and commodity prices are high. So they are facing headwinds."

First Published: Apr 19, 2022 8:49 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM