By CNBCTV18.com Apr 20, 2023 12:52:38 PM IST (Updated)

Listen to the Article(6 Minutes)

Shares of leading manufacturer of diesel and natural gas engines and power generators Cummins India Ltd gained 3 percent in morning trade on Thursday even as analysts are divided over its export prospects.

Kotak Institutional Equities has termed the stock as its top pick in the capital goods category and recommended a ‘buy’ call with a target price of Rs 1,810 per share, implying a potential upside of around 20 percent.

On the contrary, BoFA Securities has changed its recommendation to ‘underperform’ from ‘buy’ as it expects more than 4 percent downside to the stock due to the global slowdown. The brokerage reduced the target price on the stock to Rs 1,434 from Rs 1,758 per share earlier.

However, Kotak Institutional Equities believes that Cummins India is structurally well-placed.

The recent announcement by its global parent to invest $1 billion in existing United States units for new products supports the case for parent outsourcing more of its base demand, which is positive for Cummins’ exports.

Exports account for a third of the total sales of Cummins India. Kotak says that Cummins India’s margin gap versus peers is reflective of a business high on the scale, localisation and market share in high-margin nodes and thus may sustain over the medium term.

BoFA Securities on Monday stated that an expected 50 percent price hike in the prices of generators after updated power generation emission norms CPCB IV+ (to come into effect from July 1, 2023) is expected to adversely impact Cummins India’s sales after the first quarter of FY24. CPCB refers to the Central Pollution Control Board.

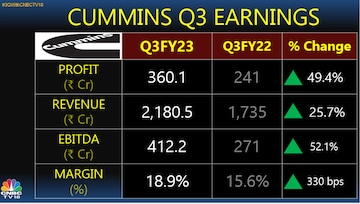

Cummins India had reported nearly 50 percent year-on-year growth in net profit at Rs 360 crore for the December 2022 ended quarter, beating the CNBC-TV18 poll estimates of Rs 268 crore. Its revenue at Rs 2,181 crore in Q3FY23 stood 26 percent higher than Rs 1,735 crore in the year-ago quarter.

| Currency | Price | Change | %Change |

|---|