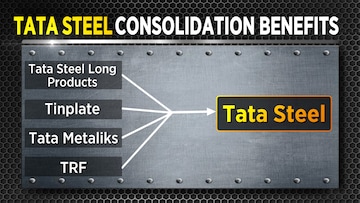

Tata Steel, one of India's largest steel producers has announced that it will combine all metal companies of the Tata Group into itself.

Under the scheme, the following companies will be amalgamated into Tata Steel:

In addition, unlisted companies like Tata Steel Mining, S&T Mining Company & Indian Steel & Wire Products will also be part of this merger.

The scheme is subject to the approval of majority shareholders of all companies in question, market regulator SEBI, and the stock exchanges, along with other authorities as applicable.

Here is the share-swap ratio for all the companies in question:

In an interview with CNBC TV-18, Tata Steel's Executive Director & Chief Financial Officer, Koushik Chatterjee, said that the move made logical sense for the company and will be accretive to its EPS.

Here's how stocks have reacted to the news in early trade:

Tata Steel: Up 3.3 percent to Rs 106.90

Tata Metaliks: Down 3 percent to Rs 779.05

TRF: Locked in a 5 percent lower circuit at Rs 356.65. First lower circuit after coming out of GSM surveillance.

Tinplate: Down 4 percent to Rs 325.20

Tata Steel Long Products: Down 8.7 percent to Rs 683.90Shares of TRF had doubled for six trading sessions between September 13 and September 20. The company attributed the movement to the stock being removed from the Graded Surveillance Measures Stage 3, under which trading in the stock could only take place once a week.

As of March 31, 2022, TRF had a net worth of negative Rs 294 crore. Since September 13, shares of TRF have been locked in upper circuits of 20 percent (twice), 10 percent (thrice) and 5 percent (thrice), based on a revision of circuit filters for the stock.

Through the merger, Tata aims to focus on growth, operational efficiencies, and business synergies. "In addition, the resulting corporate holding structure will bring enhanced agility to the business ecosystem of the merged entity," the company wrote in an exchange filing.

Rakesh Arora of Go India Advisors believes that although the merger announcement is positive from a long-term perspective, it does not change much for Tata Steel companies in the near term. However, there will be some savings on administrative costs.

"It makes sense for the metal companies to be together," Market Expert Anand Tandon told CNBC TV-18. "There is absolutely no reason to have multiple businesses which are in different stages, especially due to the tax implications," he said.

Here are some common synergy benefits that Tata Steel sees through the amalgamation of its subsidiaries with itself: Operational integration, better facility utilisation, reduction of operational costs and improved sales

Centralised procurement and inventory management

Efficiency in working capital and cash flow management

Improving raw material security

Faster execution of projects in the pipeline

Rationalisation of logistics costsFirst Published: Sept 23, 2022 7:46 AM IST