Home

Terms and Conditions

Stock Market Highlights: Nifty 2 pts shy of 17,500 led by financial, auto, IT shares; ONGC drops 5%

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live market coverage on March 30, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Catch latest from CNBCTV18.com's coverage of Russia-Ukraine war

Time to be cautious in market: Dinshaw Irani

Dinshaw Irani, CIO of Helios Capital India, believes investors need to be cautious at the current juncture. "You have seen the rural demand wane for a very long time. In fact, that also is not abating. There are been sound bites about even urban side where some consumer durables and non-durables are seeing some downgrading and so on... That is an area of concern. You are going to compare the March quarter to a very heavy March quarter last year, which was just out of a lockdown, and you are seeing a lot of revenge buying and so that comparison will not hold good," he says.

"We are probably being cautious with our investors’ money... Next couple of months are going to be fairly trying... We will just look at the market; how they play out and probably then take a call going forward," Irani adds.

Expect gas rates to go up, city gas distributors to suffer: Sudip Bandopadhyay

Sudip Bandopadhyay, Group Chairman at Inditrade Capital, expects gas prices to go up, making city gas companies suffer. He is extremely cautious on city gas companies. He is bullish on ONGC and Oil India from a fundamental perspective. He believes that after the Russia-Ukraine war, geopolitical sensitivities will make pretty much all the governments look at generating oil to the extent possible by domestic companies.

"We have not seen a significant increase in capacity as far as ONGC is concerned for the last five years. It is high time the focus is brought on production increases and other efficiencies as far as ONGC goes. We can look at buying ONGC with a one-year-plus time horizon in mind,” he says.

ITC remains top consumption pick: Nischal Maheshwari

Centrum Broking's Nischal Maheshwari has ITC as his top pick in the consumption space. He also likes Dabur, Emami and Britannia.

"We have several consumption stocks on our 'buy' radar. But by and large, the issue is inflation. The commodity price increase that you have seen is impacting the consumption companies. Given that demand is not very strong, most of these companies have not been able to pass it on... So in the next 1-2 quarters, there will be margin pressure and that is why you are seeing this correction," he says.

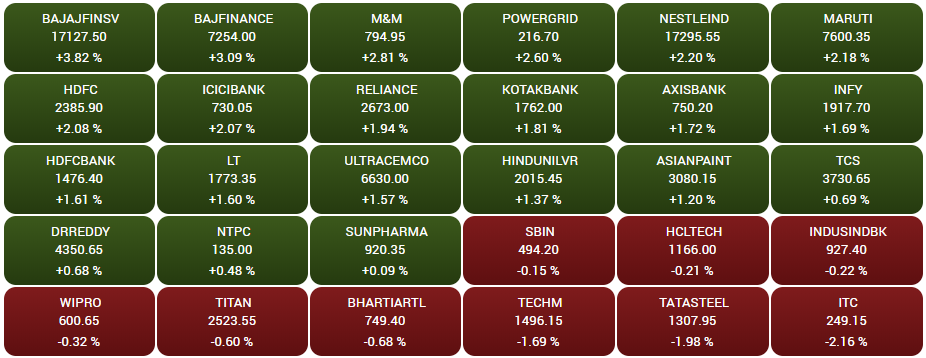

Market At Close | Reliance, HDFC twins, ICICI Bank lift Nifty by more than 100 points

Here are some highlights:

--Metal stocks slip following fall in commodity prices; Nifty Metal down 2 percent

--Nifty Bank rises 487 points to 36,334; midcap index up 248 points at 29,591

--ONGC top Nifty loser; OFS floor price at discount to CMP

--ITC falls for 2nd day, stock down over 2 percent

--Tata Consumer rises 2 percent after co announces simplification of structure

--Bajaj twins among top Nifty gainers, up around 3 percent

--Reliance continues to gain momentum, hits 5-month high

--L&T Info, Godrej Conssumer, Dalmia Bharat, Ramco Cements top midcap gainers

--Nalco, JSPL, Vedanta, L&T Finance, Aurobindo Pharma top midcap losers

--Market breadth favours bulls; advance-decline ratio at 2:1

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Closing Bell | Sensex up 740 pts, Nifty 2 pts shy of 17,500

The Sensex finishes the day up 740.3 points or 1.3 percent at 58,684 and the Nifty50 at 17,472.3, up 147 points or 0.9 percent from its previous close. (Read more on the closing bell)

Hero MotoCorp refutes report of false expense claims; calls it speculative

Two-wheeler market leader Hero MotoCorp has denied the report of the IT Department finding Rs 1,000 crore false expense claims, saying it is speculative.

BSE IT index up 1% supported by Vakrangee, Nucleus Software Exports, Subex

Govt to announce revised natural gas price for next 6 mths, tomorrow

Reliance set to get a record price of $10/mmBtu for the KG Gas while ONGC may fetch more than double the rate for its Mumbai High & other fields.

Financial, auto, IT stocks help Nifty50 test 17,000: Key factors impacting market now

Indian equity benchmarks extended gains to a third straight day on Wednesday, led by financial, auto and IT shares even as metal shares played spoilsport. Globally, optimism on progress in negotiations between Russia and Ukraine boosted sentiment. The 30-scrip Sensex index jumped as much as 721.4 points or 1.2 percent to 58,665 and the broader Nifty50 benchmark rose to as high as 17,513.9, up 188.6 points or 1.1 percent from its previous close.

Cabinet approves amendment in Mega Power Policy 2009 for provisional mega power projects

Cabinet approves amendment in Mega Power Policy 2009 for provisional mega power projects. Extension to enable developers to competitively bid for future PPAs and get tax exemptions. Increased liquidity to ensure the revival of various stressed power assets.

ITC surges 17% in March, most among peers

Shares of ITC Ltd surged nearly 17 percent in March, the most in sixteen months, even as its peers dropped on fears of margin pressure due to rising input costs. The stock has been an underperformer for the past few years due to stagnant financials, ESG concerns and exposure to COVID. Peers such as Godrej Consumer lost 8 percent in March, Nestle India dropped 3 percent, Hindustan Unilever declined 8 percent, Dabur India 7.6 percent while Marico fell 5.4 percent.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|