Home

Terms and Conditions

Stock Market Highlights: Sensex ends volatile session 231 pts higher as financial shares rebound, Nifty reclaims 17,200

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live market coverage on March 28, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Catch latest from CNBC-TV18's coverage of Russia-Ukraine war

Don't think Tata Elxsi upmove has anything to do with fundamentals: Hemang Jani

Hemang Jani of Motilal Oswal Financial Services is of the view that the upmove in Tata Elxsi is because of expectations of inclusion in MSCI indices. "As we all know, the floating stock for some of these names is very small. When one is expecting a significant inflow because of MSCI inclusion, the price impact tends to be very high. It's a great quality stock in the sense that in the midcap IT, it covers mobility and certain emerging themes," he says.

Jani says the move is actually due to a technical factor because of the MSCI adjustment.

A few new age cos in pole position to change consumer habits: Harish Krishnan

Harish Krishnan, Executive VP and Senior Equity Fund Manager at Kotak AMC, believes that a few new age companies are in a pole position to change consumer habits. "All the new age businesses are essentially a bet of optionality that can play out into the future... They are loss making and there is pressure on loss making companies today with the elevated yield curve. There is also a question mark on whether the capital, which was very abundant in the last 24 months, will be available to them. We continue to have a promising outlook towards quite a few of the new age businesses but we treat them as option values,” he says.

Rupee ends marginally higher at 76.16 vs US dollar

The rupee finishes the day at 76.16 against the greenback. On Friday, it had settled at 76.20.

Anindya Banerjee, VP-Currency Derivatives and Interest Rate Derivatives at Kotak Securities, expects the rupee to remain rangebound between 75.75 and 76.50 over the near term.

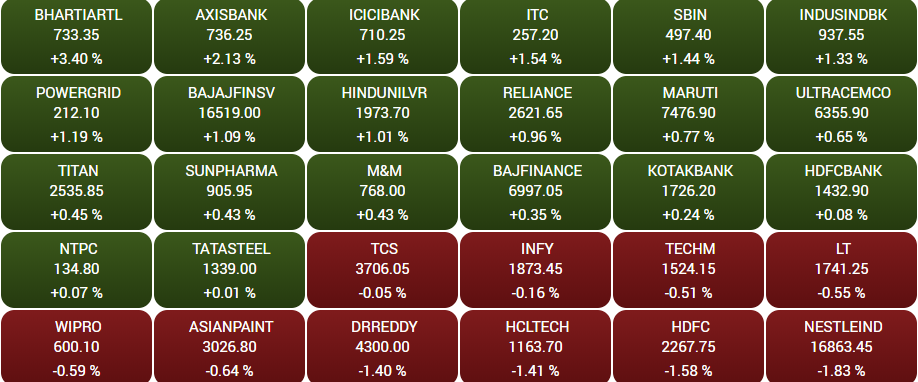

Market At Close | Sensex, Nifty50 near day’s highs boosted by a recovery in financial stocks

Here are some highlights:

--Sensex, Nifty, Nifty Bank gain 1-2 percent from day's lows

--Reliance Industries continues to support Nifty, within 4 percent of 52-week high

--Bharti Airtel surges 3 percent after analyst meet

--Indus Towers gains despite Bharti Airtel buying 4.7 percent stake below CMP

--ITC continues to gaining momentum, up nearly 20 percent so far this month

--PVR, Inox Leisure surge on merger announcement

--Atul rises 4 percent

--GNFC, Bank of Baroda, GAIL, Cummins, NMDC top midcap gainers

--Escorts, CONCOR, Max Financial, BHEL, Polycab, NBCC, Firstsource top midcap losers

--Midcap underperformance keeps market breadth in favour of bears; advance-decline ratio at 2:5

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

PVR-INOX Leisure deal positive: Gurmeet Chadha

Gurmeet Chadha, Co-Founder and CEO of Complete Circle Consultants, finds the deal between the two multiplex operators to be positive. "As the economy opens up, people want to move out and what this creates is it creates somebody with a box office market share of 40-50 percent... I think there will be lot of synergies that will work out over a period of time. There is this trend also from a single- to multi-player that will pay out. Overall, it is pretty constructive in my view," he says.

PVR-INOX deal to require CCI nod based on asset value, turnover: J Sagar Associates' Vaibhav Choukse

Vaibhav Choukse, Partner-Competition Law at J Sagar Associates, believes the proposed deal between PVR and INOX Leisure will require competition watchdog CCI's approval based on their asset value and turnover. "If you look at this deal typically, although it is a mega deal but what particularly they are trying to do is to claim an exemption, which is provided by the central government and is called a target exemption. Typically, it says that a deal will not require an approval from the Competition Commission of India if the parties have an asset value of less than Rs 350 crore in India or a turnover of less than Rs 1,000 crore," he says.

"If you see the balance sheets, and profit and loss accounts of the companies, I believe they are qualifying for these particular thresholds as their turnovers do not exceed Rs 1,000 crore in India in the last preceding financial year. Now, if that is the case, the deal is exempted from CCI's standard point and the regulator will have no jurisdiction to review this particular deal," he explains.

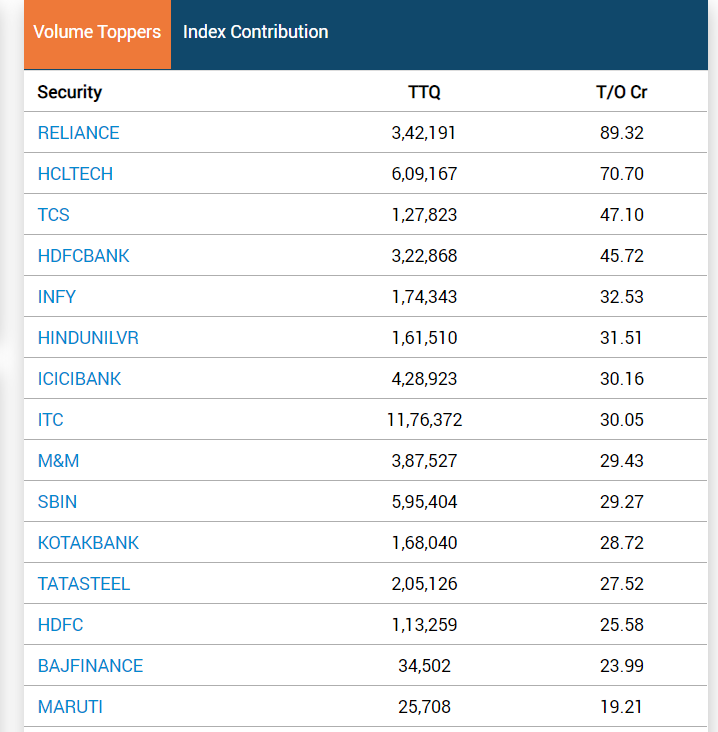

Reliance Industries, ICICI Bank, Bharti Airtel top index movers

Axis Bank and ITC also among the biggest contributors to the gain in both headline indices.

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Market At Close | UPL, SBI Life, Nestle, HDFC, HDFC Life top blue-chip laggards

Adani Paints, Larsen & Toubro, Wipro, Bharat Petroleum and Tech Mahindra also among the top losers. On the other hand, Bharti Airtel, Coal India, Axis Bank, Eicher Motors and ICICI Bank rise the most among the top gainers.

Here's how the 30-scrip basket looks like:

March could be 6th straight month of FII outflows for Indian equities

Provisional exchange data shows foreign institutional investors (FIIs) have withdrawn a net Rs 46,961.6 crore from Indian equities in March as of Friday. In the five months to February 2022, FIIs pulled out a net Rs 1,88,034.1 crore.

FII outflows have been one of the key factors behind the recent pause in Indian shares after a chain of record highs. (Read more on FII flows)

Closing Bell | Sensex up 231 points at 57,593, Nifty50 at 17,222

Both headline indices finish the choppy session up 0.4 percent. The Sensex rises 231.3 points to end at 57,593.5 and the Nifty settles at 17,222, up 69 points from its previous close. (Read more on the closing bell)

Best strategy now is to be on sidelines, remain invested: Sanjay Dutt

Sanjay Dutt, Director at Quantum Securities, believes that the best strategy now is to be on the sidelines, and for existing investors to stay invested in the market. The outlook for the next few months or 1-2 years is positive, he says.

"We are going through a very good period of consolidation. We have had a lot of volatility over the last few weeks. That's kind of settling down now. We are going through a very good phase of consolidation after hitting the lows and bouncing back for those 15,700 levels (Nifty50)."

His advice: It is a good time to revisit your portfolio, and to focus on high conviction ideas.

"It's time to be in equities for the next 4-5 years. Therefore, don't worry, but make sure that you have the right bets in your portfolio and just continue to be invested. But you want to take fresh calls, maybe just wait it out and you may get a little lower levels as part of this consolidation. But I don't see really the market falling off the cliff as such," he adds.

Ruchi Soya FPO update | Total subscription: 2.3 times, QIB:1 time, NII:8 times, Retail:0.7 times till 1:30 pm

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|