Home

Terms and Conditions

Stock Market Highlights: Sensex ends 59 pts lower, Nifty slips below 17,300; Ambuja Cements falls 6%, Nestle down 1%

Live Updates

Thank you, readers! That's all from CNBC-TV18.com's live market coverage on February 18, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Catch latest from CNBC-TV18's coverage of Russia-Ukraine conflict

Market This Week | Banking, metal shares drag Sensex, Nifty50

Here are some highlights:

--Sensex, Nifty50 extend losses to 2nd week; midcap index falls over 2 percent for 2nd week

--Nifty Bank slips 2.5 percent, biggest weekly fall in 2 months

--Except IT, all sectoral indices fall

--Volatility index gains 19 percent, biggest weekly gain in 3 months

--PowerGrid, JSW Steel, UltraTech, ICICI Bank, Tata Steel top Nifty losers

--Eicher, TCS, Tata Cons, HUL, Reliance Industries, Titan top Nifty gainers

--Manappuram, Metroplis, Astral, Firstsource, Hindustan Copper top midcap losers

HDFC valuation attractive, company has a pristine record in managing bad loans: Dipan Mehta

Dipan Mehta, Director at Elixir Equities, believes HDFC shares are available at an attractive valuation. With real estate picking up volume, demand for housing loans should increase going forward, he says.

"HDFC has a pristine record when it comes to managing NPAs, and it clearly has the formula... Right through all the turmoil in NBFCs, it was almost unimpacted... From a longer term point of view, if you want a stable secular growth story, HDFC certainly checks all the boxes... Its underlying profit growth will still be around that 15 percent or thereabout and that is the kind of return that you can expect from HDFC. As and when some more value unlocking takes place in its subsidiaries, you could have those occasional incomes coming in and bumping up the quarterly numbers," he adds.

Volatility may continue in near term due to global uncertainties: TejiMandi's Vaibhav Agrawal

Vaibhav Agrawal, CIO and Founder at TejiMandi, believes volatility may continue in the near term on account of global uncertainties such as the Fed policy, inflation and geopolitical tensions.

"Investors should treat volatility as a friend rather than an enemy. India is on a structural upcycle for the next 3-5 years. Three major cycles have turned positive after almost 7-8 years. Corporate earnings should grow at a 15 percent CAGR over the next 3-5 years. The banking asset quality cycle is also improving after almost six years and even real estate has turned upwards after almost 7-8 years," he tells CNBCTV18.com.

His advice: Investors should use volatility to gradually buy stocks given that India is firmly on an upcycle.

Is volatility here to stay?

According to Ruchit Jain, Lead Research at 5paisa.com, recent historical data suggests the India VIX had risen up to 24 levels ahead of important events but cooled off after the event. "The volatility index is at the higher end of the range due to uncertainty around the Russia-Ukraine conflict. It is trading at higher levels, but we believe that in case there are no escalations between Russia and Ukraine, we would see the markets gain stability and volatility should then cool off," he tells CNBCTV18.com.

Only a rise above 24 on the VIX will be a cause of concern for the market, he adds.

Likhita Chepa, Lead of Technical Research at CapitalVia Global Research, told CNBCTV18.com she expects volatility to persist in the Indian market, with impact from rising commodity prices, a hawkish Fed policy and global market sentiments in the coming period.

Her advice to investors: Avoid fresh longs and wait for significant corrections before buying, and maintain a stock-specific approach going forward.

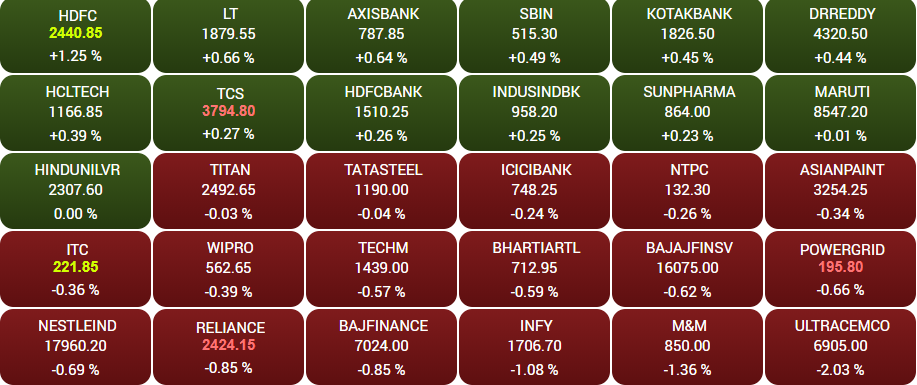

Market At Close | Sensex, Nifty edge lower; Russia-Ukraine updates keep investors on back foot

Here are some highlights:

--Kotak Bank, SBI, Axis Bank help Nifty Bank Close stay in green

--Midcap underperformance keeps mkt breadth in favour of declines

--Midcap index falls 1 percent

--ONGC top Nifty loser; crude oil down 2 percent, Brent back at $91/barrel

--Pharma names underperform; Divi’s, Cipla down 2 percent

--UltraTech, Tata Motors, Shree Cement, M&M top index losers

--Coal India top Nifty gainer, up 2 percent after company releases FY22 despatch data

--SBI Life, HDFC, Bajaj Auto, L&T among top Nifty gainers

--Ambuja Cements top midcap loser, down 6 percent after weak Q4 earnings

--Motherson, Firstsource, Indiamart, Honeywell, Piramal top midcap losers

--India Cements, Voltas, Torrent, IPCA, Berger paints top midcap gainers

--NSE advance-decline ratio at 2:5

European shares rise on hopes of diplomatic end to Ukraine standoff

European share markets begin the day on a positive note, as investors grow hopeful of a diplomatic end to the Ukraine standoff. The pan-European Stoxx 600 index was up 0.2 percent at the last count. Oil prices rise on the prospect of Iran returning to the market.

--UK's FTSE: up 0.3%

--France's CAC: up 0.5 percent

--Germany's DAX: up 0.1 percent

S&P 500 futures up 0.5 percent, suggesting a positive opening ahead on Wall Street.

Catch latest from CNBC-TV18's coverage of Russia-Ukraine conflict

Market At Close | Coal India, SBI Life, Bajaj Auto, HDFC, L&T top blue-chip gainers

Axis Bank, Kotak Mahindra Bank, Dr Reddy's, TCS and SBI also among gainers. On the other hand, ONGC, Divi's, Cipla, UltraTech, M&M, Tata Motors and Shree Cement the worst hit among the 33 laggards in the Nifty50 pack.

Here's how the 30-scrip basket fared:

Closing Bell | Sensex ends 59 pts lower, Nifty50 slips below 17,300

Both headline indices fail to hold on to the green in a choppy session. The Sensex ends 59 points or 0.1 percent lower at 57,833 and the Nifty50 settles at 17,276.3, down 28.3 points or 0.2 percent from its previous close.

Cement sector as a whole getting rerated: Prakash Diwan

Market expert Prakash Diwan is of the view that cement players are looking at capacity expansion and the whole sector is in for a rerating. "The price changes that are underway will probably stabilise at some point in time. Eventually, the sector will perform. Dalmia Bharat continues to be one of my top favourites here... UltraTech Cement is the Asian Paints of the cement sector," he adds.

"You really don't have much to go wrong in that sense. It will weather the storm irrespective of what happens to smaller ones. Aplha generation is probably going to be in mid-size players like Dalmia, which is more promising," he adds.

Energy stocks mixed after hydrogen policy announcement: Adani Energy rises; Indian Oil, NTPC fall

Shares of energy companies that have or are planning to invest in green energy mixed, a day after the government unveiled the first part of the much-awaited National Hydrogen Policy.

The policy allows free inter-state wheeling of renewable energy used in the production of green hydrogen and ammonia. The government aims to promote the use of carbon-free fuel and make India an export hub. (Read more)

India's air passenger traffic down 43% MoM in January: DGCA

Air passenger traffic in the country stood at 64.08 lakh in January, down 17 percent on a year-on-year basis, data from aviation regulator Directorate General of Civil Aviation (DGCA) showed. The air passenger traffic was down 43 percent sequentially. (Read more on DGCA data)

SBI, SBI Life, HDFC, ICICI Prudential top BFSI gainers

| Index | Change (%) |

| SBILIFE | 2.3 |

| ICICIPRULI | 1.4 |

| HDFC | 1.0 |

| MUTHOOTFIN | 0.5 |

| AXISBANK | 0.4 |

| SBIN | 0.3 |

| HDFCBANK | 0.1 |

| KOTAKBANK | 0.1 |

| ICICIBANK | -0.1 |

| HDFCAMC | -0.4 |

| HDFCLIFE | -0.4 |

| CHOLAFIN | -0.4 |

| ICICIGI | -0.5 |

| PFC | -0.6 |

| RECLTD | -0.7 |

| BAJAJFINSV | -0.7 |

| BAJFINANCE | -0.8 |

| M&MFIN | -1.6 |

| SRTRANSFIN | -1.6 |

| PEL | -3.3 |

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|