Home

Terms and Conditions

Stock Market Highlights: Sensex ends 105 pts lower, Nifty at 17,305; Nifty Bank down 1%

Live Updates

Thank you, readers! That's all from CNBC-TV18.com's live market coverage on February 17, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Catch latest from CNBC-TV18's coverage of Russia-Ukraine conflict

Market At Close | Financial stocks drag Sensex, Nifty50 below flatline; Russia-Ukraine updates in focus

Here are some highlights:

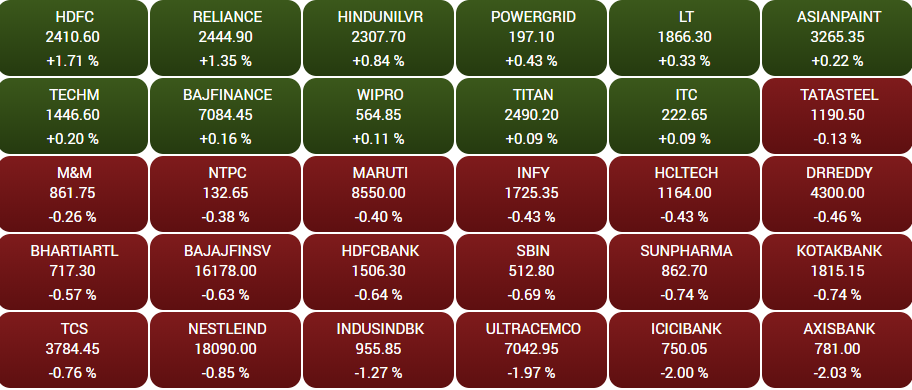

--All Nifty Bank constituents in the red; ICICI Bank, HDFC Bank, Axis Bank top losers

--Benchmarks outperform relatively; RIL, HDFC major supports to Nifty

--ICICI Bank, HDFC Bank, Axis Bank drag Nifty by 39 points

--Nestle down after in-line set of earnings for December quarter

--ONGC rises 2 percent after rebound in crude; Brent back above $94/barrel

--Capital good stocks see healthy gains on positive brokerage note; Siemens up over 2%

--Shriram Transport, Navin Fluorine, ICICI Pru, Cummins, Page Industries top midcap gainers

--NMDC, Nalco, Muthoot Finance, Alembic, Bharat Forge top midcap losers

--Market breadth favours bears; NSE advance-decline ratio at 1:2

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Catch latest from CNBC-TV18's coverage of Russia-Ukraine conflict

Closing Bell: Sensex, Nifty fail to hold on to day's gains; Nifty Bank falls 1%

The Sensex down 104.7 points or 0.2 percent at at 57,892 and the Nifty50 at 17,304.6, down 17.6 points or 0.1 percent from its previous close. (Read more on the closing bell)

Adani Wilmar shares extend losses to 2nd day, sink over 4%

The shares of the newly-listed Adani Wilmar extended losses to the second straight day on Thursday. Adani Wilmar's share price slipped 4.3 percent to an intraday low of Rs 360.60 on the BSE.

Nestle shares fall after FMCG major's Q4 profit, revenue misses Street estimates

Nestle India shares slid into negative territory on Thursday after the FMCG major reported its quarterly net profit and revenue fell short of Street estimates. The Nestle stock dropped as much as 1.5 percent to Rs 17,969.3 on BSE after the earnings announcement, having stayed in the green for much of the session earlier in the day.

Kaustubh Pawaskar, Sharekhan on Nestle Q4 numbers

“I think numbers are better on margin front, revenues came largely in line with what we and street were anticipating at around Rs 3740 crore odd, but the important part is operating margins, which came at around 23 percent I think street was anticipating at around 21-21.5 percent. So at operating profit level, the numbers were quite good, and there was a onetime exceptional hit but if you exclude that Rs 623 crore of PAT, I think it was better than what we were anticipating,” said Kaustubh Pawaskar of Sharekhan.

The company reported an overall decent set of numbers in the current environment. He added that Nestle is less impacted because of the rural slowdown or the even the raw material or input cost inflation. Nestle is better poised as compared to other FMCG companies, he said.

“So, I think things would come back on track and also we need to consider that out of home categories this quarter has seen good bit of recovery. So, I think that would continue and which will help Nestle to achieve consistent kind of top line growth in the coming quarters,” Pawaskar explained.

We have a target price of Rs 22,395 and he believes the stock has corrected from its highs and any correction in quality stock like Nestle, is a good entry point. So Pawaskar believes that whenever there is a healthy correction in stocks like Nestle, I think it is a good opportunity to enter into the stock.

Murudeshwar Ceramics shares zoom 14%

Promoter stake rises by 5 percent after conversion of warrants into equities. With this, shares of Murudeshwar Ceramics gain 14 percent.

Advani Hotels soars 20% after Radhakishan S Damani raises stake

Shares of Advani Hotels & Resorts India soared 20 percent on Thursday after ace investor Radhakishan S Damani and his family increased their stake in the firm. In intraday, the stock hit a high of Rs 97.80 on BSE.

From Tata Motors to Bajaj Auto to TVS Motors, top stocks to benefit from EV boom

--Tata Motors enjoys 90 percent market share in the EV passenger segment. Its highest-selling EV in India: Tata Nexon. Tata Motors EV sales are up six times in the last 12 months.

--Bajaj Auto has invested Rs 300 crore in an EV plant in Pune that will have a production capacity of 5,00,000 units a year by June 2022. (Find out which other companies are on the list and why)

Market Watch | George Heber Joseph, CEO & CIO at ITI Mutual Fund on consumer discretionary space

“Consumer centric businesses got related massively in the last 10 years. We believe that infrastructure is going to come back in a big way and the signs of that are pretty much there and we are extremely bullish on the infrastructure theme to play for the decade,” said George Heber Joseph, CEO & CIO at ITI Mutual Fund.

He thinks that the government capex has already picked up now, private capex also will follow suit.

“If you look at the government budgets also is pretty much aligned to this particular theme. And we are quite bullish on the capex cycle story. This is the time to ditch the consumer theme, some of the discretionary plays we like but consumer staples is pretty much we are underweight heavily and we think that they are going to underperform massively, mainly because of the fact that they are extremely overvalued. They are at the peak margins and the growth rates also have peaked out. So we feel that there is significant room for disappointment in this particular sector. We are more bullish on the discretionary space here and also on the capex theme,” Joseph said.

Market Watch | George Heber Joseph, CEO & CIO at ITI Mutual Fund on energy space

Reducing carbon and increasing green energy is the way forward, that is pretty much clear. These themes are pretty much interesting to look at, there are companies in that space which are looking to invest huge amounts of money, and which has already been announced by some of the large players in the industry, said George Heber Joseph, CEO & CIO at ITI Mutual Fund.

The green policy, whatever government is putting it out, I think it will create a clear corridor for people to invest and make money in that sector, he said.

“Large themes like this - when you talk about EV, or your new talk about green energy, or ESG, these are all big themes, which is working globally and going against that theme is not a good idea. Obviously, these are all linked to certain government policies and practices, which we have to keep in mind, for we are quite positive on this theme,” Joseph added.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|