Home

Terms and Conditions

Stock Market Highlights: Sensex ends 198 points higher, Nifty reclaims 17,500 as market rebounds after 4 days of losses

Live Updates

Thank you, readers! That's all from CNBC-TV18.com's live market coverage on November 23. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Market At Close | Bharti Airtel rises 2% after brokerages raise target price following tariff hike

Here are some highlights:

--Nifty Bank gains 144 points to 37,273; midcap index rises 534 points to 30,865

--Bharti Airtel rises over 2% after brokerages raise target following tariff hike

--Vodafone Idea fails to hold gains following tariff hike, ends flat

--Reliance Industries recovers 3% from lows to end 1% higher

--IndusInd Bank top Nifty loser; lender, Spandana spar over leadership appointments

--Vedanta surges 6% after promoters buy over 5% equity via block deals

--Glenmark, Birlasoft, Strides, BHEL, Vedanta, Indiabulls Housing top midcap gainers

--Syngene, Thermax, Dr Lal, Info Edge, Berger Paints top midcap losers

--Market Breadth favours bulls; advance-decline ratio at 7:2

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Remain positive on India telecom story: Mehraboon J Irani

Market expert Mehraboon J Irani remains positive on the country's telecom story. "The question is whether you buy Bharti Airtel as a trading bet. The answer is: Certainly not. But if one has it in the portfolio, and one wants a proxy for the telecom sector, I think certainly one will continue to hold on to it. Will the stock be higher than where it is right now or the next one? Yes. They have taken care of the liquidity problem with the recent rights issue. The tariff hike also was a definitely a welcome move and should definitely help the company in as far as the incremental revenue to EBITDA goes. I think all said and done, it is a big positive for Airtel and we now need to need to see what Jio does," he said.

Sushil Kedia remains bullish on telecom stocks

Sushil Kedia, Founder of Kedianomics, continues to be bullish on telecom stocks. "They did not come down at all in this market correction. So we will continue to ride them with trailing stops," he said.

Steel sector fundamentals rosy: Sushil Kedia

Sushil Kedia, Founder of Kedianomics, believes the fundamentals for the steel sector are rosy. The Street is very bullish and an interim trading rally is there but for those who have the appetite to hold, a 10 percent further risk doesn’t make much difference, he said.

"It is a zone to buy. If you are betting for SAIL to go to Rs 180-200, it is already a good time to buy. However, for leveraged traders, steel may not be the best place right now to take big bets on,” he said.

Nifty has immediate support at 17,200, resistance at 17,600: Choice Broking's Palak Kothari

The Nifty has immediate support at 17,200 and resistance comes in at 17,600 levels, said Palak Kothari, Research Associate at Choice Broking. Once the index takes out the hurdle, it can rise to 17,800-17,900 levels, he said.

The Bank Nifty has support at 36,300 and resistance at 38,000, Kothari added.

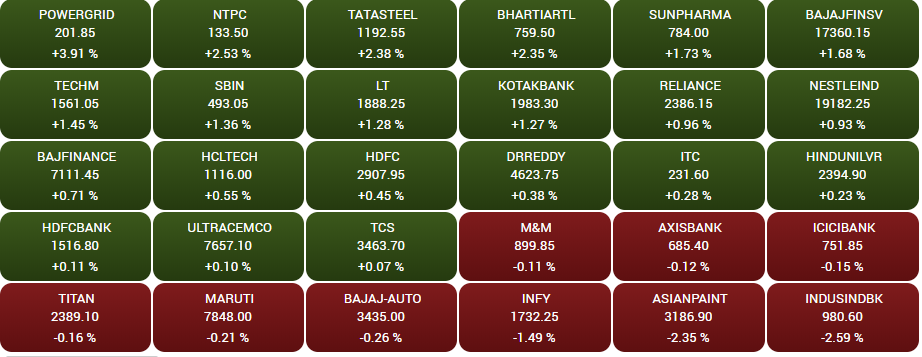

Market At Close | Power Grid, JSW Steel, Coal India, NTPC top Nifty50 gainers

On the other hand, Asian Paints, IndusInd Bank, Infosys, Axis Bank and Titan, closing between 0.3 percent and 2.6 percent lower, were the worst hit among the 10 laggards in the 50-scrip index.

A total of 21 stocks in the 30-member Sensex index closed in positive territory.

Sensex, Nifty close higher after 4 days of losses

Closing Bell | Sensex rebounds 946 points from day's low, snaps 4-day losing streak; Paytm shares jump 9%

Indian equity benchmarks made a comeback on Tuesday after four straight sessions of losses, helped by gains in financial, oil & gas and metal shares. The Sensex index ended 198.4 points or 0.3 percent higher at 58,664.3, rebounding 946 points from its intraday low of 57,718.3. The broader Nifty50 benchmark settled at 17,503.4, up 86.8 points or 0.5 percent from its previous close. In the past four sessions, the 30-scrip index had shed 2,252.8 points (3.7 percent) and the Nifty lost a total of 348.3 points (3.8 percent). (Read more on the closing bell)

Positive on healthcare shares: Rohit Srivastava

Rohit Srivastava, Founder and Strategist at Indiacharts.com, believes that all sectors that have taken a beating in the recent past should start to participate again. "Healthcare has already paused and turned to the upside over the last few weeks. So that should also participate. Why look away from those which was strong during this period except that some of them could consolidate like power as a very good phase. But we do sense that there is space there for consolidation, but when it comes to the auto sector, it has been strong so could continue to be strong. So there is a mix of those but while we focused on the stronger ones for quite a while at the depth of this why not even focus on the ones which were strong on a one year basis but have actually seen a correction in the recent time period and which is where metals come in," he said.

CNBCV-TV18 Exclusive | Parle hiked prices by 10-15% in Q2, to hike by 10-20% in Q3, Q4

Parle's management said in an exclusive interaction with CNBC-TV18 that it would hike its prices by 10-20 percent in the third and fourth quarters of the current financial year, following a hike of 10-15 percent in the three months to September. The price of Parle biscuits is being hiked by 5-10 percent, it said.

The FMCG major said the decision is on account of tremendous input cost pressure.

The company has reduced the grammage for low-unit packs, maintaing the MRP at the existing level.

TCNS Clothing, Raymond, Glenmark Pharma, Birlasoft, Triven Turbine top BSE 500 gainers

CESC, Vedanta, HFCL, Strides Shasu, Gateway Distripark, MRPL and Greaves Cotton were also among the top gainers in the BSE 500 universe. Around 400 stocks in the broadest index on the bourse were in positive territory.

Future Retail employees file ‘special leave’ plea in Supreme Court to intervene in Amazon dispute proceedings

The Future Retail Employee Welfare Association has filed a special leave petition in the Supreme Court seeking to intervene in the current proceedings of the company’s dispute with Amazon over its 2019 deal with Reliance Industries. The employees’ association has stated that the interests of nearly 27,000 employees of Future Retail have been affected by the orders passed in arbitral proceedings. They say the inordinate delay in the Future-Reliance Retail deal has caused apprehension in employees that the deal may not reach fruition. (Read more)

Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Haven't applied for an IPO since 1992, better picture emerges 6-12 months after listing: Rohit Srivastava

Rohit Srivastava, Founder and Strategist at Indiacharts.com, has not applied for an IPO since 1992. "The last time I did, I did one for the first and the last time, and there is a reason for that. When you are more of a market analyst who looks at multiple things, technicals, fundamentals and so on, one thing I have found is that after a stock gets listed, and you give it time, which is 6-12 months, you are able to take a much better picture of the situation," he said.

"By the time they are in the market, you really have to judge whether all the growth is priced in or not, which is a very tough job. So the easier thing is to let the market decide and sometimes, six months later, you are surprised that the stock is actually down, as we saw in the case of Just Dial, and you are seeing some of the reaction in Paytm. However, maybe one year down the line, it may look different," he added.

Paytm shares surge nearly 12%

Paytm parent One97 Communications' shares traded 11.6 percent higher at Rs 1,517.9 apiece on BSE in late afternoon deals. At the current level, the stock quoted at a discount of 29.4 percent to its issue price after a series of losses following its weak debut.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|