Home

Terms and Conditions

Stock Market Highlights: Sensex ends 657 pts higher, Nifty reclaims 17,450; Maruti up 4%, Adani Wilmar surges 20%

Live Updates

Thank you, readers! That's all from CNBC-TV18.com's live market coverage on February 9, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Expect rupee to move within 74.50-75.20 range in near term: Anindya Banerjee

Anindya Banerjee, DVP-Currency Derivatives and Interest Rate Derivatives at Kotak Securities, expects the rupee to move within a range of 74.50-75.20 against the greenback in the near term.

"Volumes remained lower than usual ahead of the RBI monetary policy on Thursday. The rupee requires a hawkish policy to appreciate but a dovish continuation from the central bank can be slightly negative. We expect the RBI to maintain a status quo on rates with a slightly hawkish policy statement," he adds.

View | Tug of war in the markets; who will win?

Senora Advisors Co-Founders Mridul Jalan and Sweta Jain expect the micro to win over the macro in the medium term. Indian markets are at a tug of war, they write, with macro headwinds on one side and improving micros on the other. (Read more)

No plan to merge Vedanta Resources with Vedanta: Anil Agarwal

Vedanta Resources will not be merged with Vedanta, Founder Anil Agarwal says in an exclusive interview to CNBC-TV18. Vedanta Resources is the parent company of Vedanta. He also says there are no plans to de-list from the exchanges.

"We are very comfortable to service the debt on the top so we have clarified very clearly that this will be our position - there is no question to merge parent company with Vedanta Limited," he said. (Read more)

Vedanta shares finish the day up 1.8 percent at Rs 376.2.

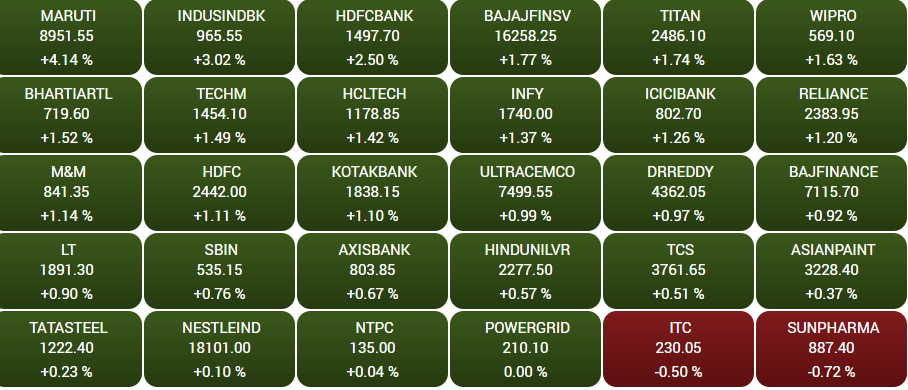

Market At Close | Banking, auto stocks help Sensex, Nifty extend gains to 2nd day

Here are some highlights:

--HDFC Bank, Reliance, Infosys, ICICI Bank top Nifty movers

--HDFC Bank contributes more than 300 points to Nifty Bank’s 588-point gain

--Nifty Bank gains 582 points to 38,610

--Midcap index up 340 points at 30,257

--Auto top gaining index; all constituents in the green

--Hero MotoCorp, Bajaj Auto, Maruti rise 2-3 percent

--Bharti Airtel rises 2% on Q3 earnings, company expects to hit Rs 200 ARPU in 2022

--ONGC top Nifty loser; crude near $90/barrel

--Coal India considering 2nd interim dividend, stock gains 5 percent

--Abbott rises 7 percent, Bosch 1 percent after improvement in earnings

--Adani Wilmar extends listing-day gains, up 20 percent

--Market breadth neutral; advance-decline ratio at 1:1

AMFI Data | Retail investors remain optimistic, says Motilal Oswal AMC's Akhil Chaturvedi

Akhil Chaturvedi, Chief Business Officer of Motilal Oswal Asset Management Company, said retail investors continue to maintain an optimistic stance when it comes investing on market dips. "On one hand, we are seeing FII outflows, on the other, we are seeing positive flows from domestic investors. This is a very positive change amongst investors," he says.

"It is always advisable to buy on dips for better rupee-cost averaging resulting in good outcomes in the long term. It is also encouraging to see positive flows in dynamic category, as most asset-allocation models are maintaining a good mix of debt and equity allocation to benefit from market corrections, and increasing equity allocations,” he adds. (Read more on MF data)

From Paytm to Latent View: How Dalal Street is reading new-age companies' Q3 results

Newly-listed new-age companies have begun 2022 with a mixed bag of earnings so far. Investors have punished several startup stocks in the recent past, from the likes of Paytm, PB Fintech and CarTrade. Here's why. (Read more on new-age stocks)

Closing Bell | Sensex up 657 points at 58,466, Nifty50 tops 17,450

Both headline indices close 1.1 percent higher, extending gains to a second straight day. The Sensex rises 657.4 points to end at 58,466, and the Nifty50 settles at 17,463.8, up 197.1 points from its previous close.

Bharti Airtel says it may achieve Rs 200 average revenue per user (ARPU) in 2022 itself

Q3 Results | Abbott India's net profit up 12.5% at Rs 199.2 crore

Abbott India surges over 6 percent after the company posted 11.8 percent jump in its Q3 revenue at Rs 1,224.4 crore. Revenue stood at Rs 1,095.4 crore last year at the same time. Net profit was up 12.5 percent at Rs 199.2 crore versus Rs 177.1 crore, YoY.

JSPL gains over 2%; January steel sales up 20%

JSPL up 2.3 percent after the company posted a 20 percent increase (YoY) in sales volume to 6.95 lakh tonnes in January 22 as compared to 5.81 lakh tonnes in January 21. Marginal improvement in rake availability during the month, resulted in export share rising to 31 percent from 28 percent in December 21.

Market Watch | Buy Federal Bank, Rain Industries: Aditya Agarwala, Yes Securities

- Rain Industries is a buy with a stop loss of Rs 220 and target of Rs 255

- Federal Bank is a buy with a stop loss of Rs 99 and target of Rs 107

Metal price at 13-year high, aluminium stocks gain

Hindalco Industries up over 2 percent and National Aluminium Company gains over 3 percent as the price of the metal crosses $3,200 a tonne - a 13-year high. Concerns that the supply-demand gap could lead to a tight market for aluminium in 2022 led to a price rise of more than 14 percent in the international market this year.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|