Home

Terms and Conditions

Stock Market Highlights: Sensex closes 257 points lower, Nifty50 below 17,850; SBI up 2%

Live Updates

Thank you, readers! That's all from CNBC-TV18.com's live market coverage on November 3. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Diwali Stock Picks | Ready for Muhurat trading? Analysts share their top bets for Samvat 2078

As investors gear up for the special, one-hour ‘Muhurat’ trading session this Diwali on November 4, brokerages have shared their top recommendations to make most of Samvat 2078 – the year that begins on the day of Diwali. (More than 60 stocks to choose from this Diwali)

Expect Federal Reserve to announce tapering of bond buys: Geojit Financial Services' Vinod Nair

Vinod Nair, Head of Research at Geojit Financial Services, said the Federal Reserve is widely expected to announce tapering of its asset purchase program in the near term.

"Any hint on a reversal in interest rates is keeping investors on the edge. Any indications showing a faster rate of tapering will have a negative effect on the equity market. Or else, we can expect a reversal from this weak trend. On a positive note, despite a rise in input costs, India’s Services PMI jumped in October owing to ongoing improvements in demand boosting the growth of sales," he added.

Expect profit booking towards immediate support at 17,750-17,700: LKP Securities' Rohit Singre

Rohit Singre, Senior Technical Analyst at LKP Securities, said the Nifty50 index appears to have formed a small consolidation zone at 17,600 and 18,000 "until we don’t see a breakout on the either side".

"We may not see a clear direction move. The index is unable to cross its strong zone of 18,000 for the last two sessions. Until we don’t cross these levels, we may not see good buying comes in, and profit booking can be witnessed towards immediate support at 17,750-17,700," he said.

TCS, Tata Consumer among top conviction bets: Purnartha Investment Advisors' Rahul Rathi

Rahul Rathi, Chairman and Fund Manager at Purnartha Investment Advisors, told CNBC-TV18 his top conviction bets now include TCS, Tata Consumer Products, DMart and Bajaj Finance.

Caution advised on market now, Fed commentary to be key: Religare Broking's Ajit Mishra

Ajit Mishra, VP-Research at Religare Broking, said all eyes would be on the Federal Reserve meeting tonight. While no action is expected on the key rates, the US central bank's commentary on tapering, growth and inflation would be a key thing to watch out for, he said.

"We will see the participants’ initial reaction on Thursday evening, November 4, in the special Diwali Muhurat trading session. We reiterate our cautious view on markets and suggest limiting leveraged positions," he added.

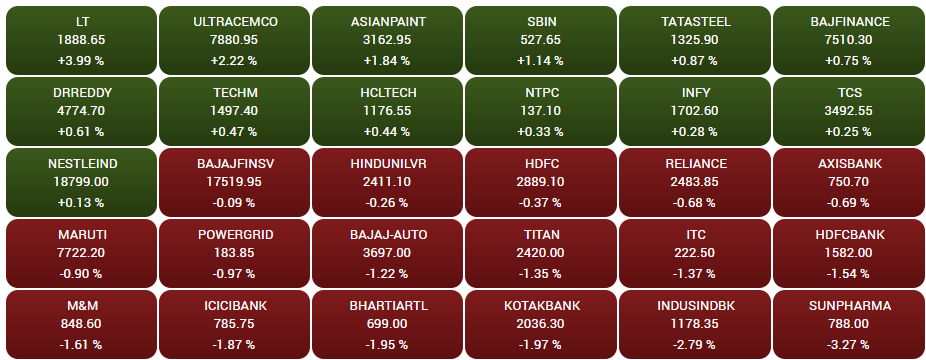

Market At Close | Private sector financial stocks drag market; Nifty Bank sheds over 500 points

Here are some highlights:

--Nifty Bank falls 536 points to 39,402; midcap index drops 84 points to 31,198

--Sun Pharma’s better-than-expected Q2 fails to boost sentiment; stock down 3%

--Bharti Airtel erases intraday gains, ends down 2% despite strong Q2

--Infra, cement, steel stocks support Nifty; L&T, Grasim, Asian Paints top gainers

--Real estate stocks continue to move higher; Godrej Properties, Oberoi Realty jump

--Escorts, IRCTC, Union Bank, Chambal Fertilisers, Bandhan Bank top midcap losers

--Trent, HPCL, Apollo Hospitals, Siemens, GSPL, India Cements top midcap gainers

--Market breadth favours bears; advance-decline ratio at 3:4

Positive on Bharti Airtel, Rs 800 mark looks achievable: Prakash Diwan

Market expert Prakash Diwan is positive on Bharti Airtel shares. "All those price objectives of Rs 800 or Rs 800 plus seem to be pretty much within reach for the stock now," he said.

"Bharti Airtel numbers probably got eclipsed with so many key earnings coming out more or less at the same time. What it tells us is that Bharti’s march towards that Rs 200 milestone on the ARPU front is something the management has not only been talking about but now also the methodology seems to be in place or the process seems to be much more clear... If they were to kind of overcome all the issues that they had in terms of AGR overhang and start seeing growth in the profitable segments of the market, there is no reason why they cannot touch that Rs 200 mark. The only caveat here is that if the JioPhone were to kind of start offering serious competition as it intensifies its distribution and marketing attempts, there could be a little bit of a slowdown. But I don’t see any reason why Bharti cannot – given a few months here and there – not achieve those milestones in the next six-twelve months and, which means that it is fairly aggressive growth that we are talking about from the commentary which is reflected," he said.

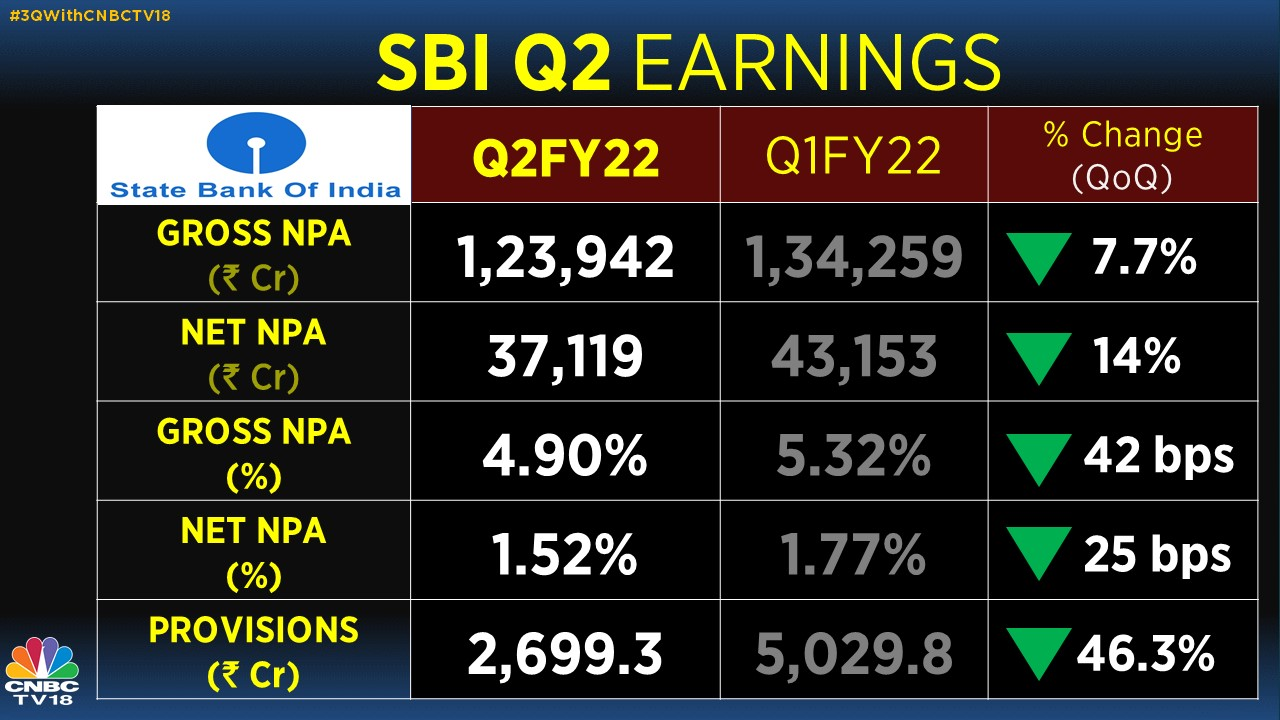

SBI Q2 | No major concern relating to asset quality on recast account Front, says Chairman

SBI Chairman Dinesh Kumar Khara said there is no major concern relating to asset quality on the recast account front. The restructured accounts are performing well, he said.

The lender is not concerned on asset quality, and its collections as well as under-writing have improved significantly, Khara added.

Closing Bell | Sensex falls 257 points to 59,772, Nifty at 17,829

The Sensex index ended 257.1 points or 0.4 percent lower at 59,771.9 and the broader Nifty50 benchmark settled at 17,829.2, down 59.8 points or 0.3 percent from its previous close. Losses in financial and oil & gas shares pulled the market lower, though gains in infrastructure, metal and select IT shares arrested the fall. (Read more on the closing bell)

SBI Chairman says credit demand improving with increasing economic activity

Here are some highlights:

--Corporates planning for future investment to help credit growth

--Provided for entire additional liability in P&L A/c with revision in family pension payable

--SBI GNPA levels have dropped below 5%

--Total restructuring at Rs 30,212 Cr (Restructuring 1.0 at Rs 12,995 crore, 2.0 at Rs 17,317 crore)

--Have a comfortable capital position

--Internal accruals to take care of SBI growth requirements

SBI Chairman says economic situation looks positive, expect recovery to pick up

SBI Chairman Dinesh Kumar Khara said the country's economic situation looks positive, and that he expects the recovery to pick up going forward.

Speaking on the lender's performance in Q2, he said the highlight of the quarter is the significant improvement in asset quality.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|