Home

Terms and Conditions

Stock Market Highlights: Sensex ends 109 points lower, Nifty50 slips below 17,900; oil & gas, metal shares drop

Live Updates

Thank you, readers! That's all from CNBC-TV18.com's live market coverage on November 2. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Caution may prevail ahead of Fed decision: Religare Broking's Ajit Mishra

"A mixed trend was witnessed on the sectoral front wherein buying in realty, PSU banking and auto packs kept traders busy. The broader indices outperformed... Participants are maintaining a cautious stance ahead of the Fed meet and we may see a similar trend on Wednesday as well," said Ajit Mishra, VP-Research at Religare Broking.

"However, the scheduled weekly expiry may trigger volatile swings in the index. Stocks, on the other hand, are still seeing noticeable traction so the focus should be on identifying the sectors/themes which are playing out well and select the stocks accordingly," he said.

Bharti Airtel Q2 | Net profit at Rs 1,134 crore, beats Street estimates

Bharti Airtel reported a net profit of Rs 1,134 crore for the quarter ended September, exceeding Street estimates. The telecom major reported revenue of Rs 28,326.4 crore for the three-month period.

Analysts polled in a CNBC-TV18 poll had estimated the company's net profit at Rs 710 crore over revenue of Rs 27,960 crore.

The company's profit was aided by an exceptional gain of Rs 540 crore.

Airtel's average revenue per user (ARPU) came in at Rs 153, in line with analysts' estimates. In the previous quarter, ARPU was at Rs 146.

Bharti Airtel shares ended 0.1 percent higher at Rs 712.9 apiece on BSE ahead of the earnings announcement. (Read Bharti Airtel Q2 earnings)

Some more upside in real estate stocks: Anand Tandon

Market expert Anand Tandon believes there is some more upside in real estate stocks. "The companies had huge inventories, and that inventory is now going away in most markets. So there is definitely now an uptick because even if you sell off your inventory, you have money to go out and build more," he said.

"So you will find that the pipeline will go up. I think it is not a short-term phenomenon, you have the wealth effect, you have low interest rates, so you will find that because of the lull that we have seen in the last few years and as the prices remain firm or start to inch up, there will be more demand,” Tandon added.

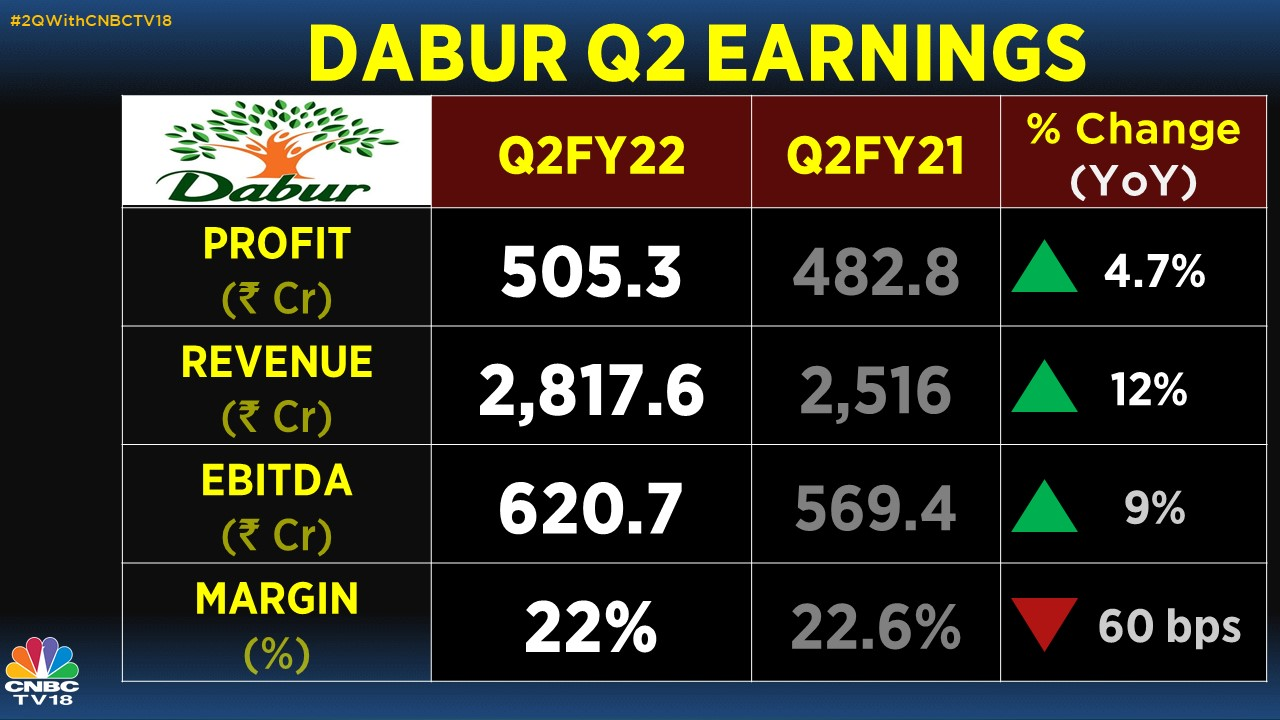

FMCG space looks quite interesting: Anand Tandon

The FMCG space looks quite interesting to market expert Anand Tandon. "I have been a bit concerned about the inflation that is coming through and to the extent that branded players will be able to pass it on, it is quite good," he said.

"Along with volume you will also get price increase and because of that you will be able to expand your bottom line much faster than you would have been in a situation where inflation was low. So, generally, I like the FMCG space per se and within that, Dabur has a niche with their own ayurvedic product range etc. So overall, Dabur is extremely well-positioned and I would be overweight on that space," he added.

Pankaj Tibrewal sees pause on earnings upgrade cycle in Q3, Q4

Pankaj Tibrewal, Senior Executive VP and Fund Manager-Equities at Kotak Mahindra AMC, believes there will be a pause on the earnings upgrade cycle. "We have been sounding a little cautious on the markets overall for the last couple of months and our view is that for the last four or five quarters, the momentum in the market was aided by a very strong earnings upgrade cycle, which led to stock prices moving very fast. What we are seeing starting September quarter now, and the result seasons is on and probably into the third and fourth quarter, is that there will be a pause on the earnings upgrade cycle. Once that happens, I think market may move sideways and that is our call that one needs to be a little cautious," he said.

. There are two pockets one need to really avoid - one is the quality name basket where they have rocky valuations and clearly the valuations have gone skyrocketing there. The other extreme is the low quality companies where the RoEs are in single digit, but they have started trading at three times, four times price to book and that valuation is clearly insane. So there are two pockets one should clearly avoid.

"There are two pockets one need to really avoid: the quality name basket where they have rocky valuations; clearly the valuations have gone skyrocketing there, and the low quality companies, where RoEs are in single digits... So there are two pockets one should clearly avoid," he added.

Early signs of capex recovery in economy: Kotak Mahindra AMC's Pankaj Tibrewal

Pankaj Tibrewal, Senior Executive VP and Fund Manager-Equities at Kotak Mahindra AMC, believes there are early signs of a capex recovery in the economy. "Our focus on cyclical is one towards the private sector and private sector financials. The second is that we believe that there is a clear revival on the earnings, on the manufacturing and the industrial capex side, and we believe that something which is looking very, very good," he said.

"There are early signs of capex recovery in the economy and we believe that part is a good portion of our portfolios. The third part is the real estate revival and we have been advocates of a real estate revival for a long period of time now and we are playing it through the entire home improvement space, cement and some of the other ancillary to the real estate sector. So this is how we are playing the entire cyclical recovery in the economy," he added.

Market At Close | Broder markets outperform Sensex, Nifty

Here are some highlights:

--Nifty Bank gains 175 points to 39,938; midcap index adds 257 points to 31,281

--Reliance Industries, metal, IT stocks drag market; auto shares lend support

--Tata Steel, Grasim, JSW, Hindalco, Tech Mahindra, HCL Tech top Nifty losers

--Titan up 2% on expectation of increased jewellery buying on Dhanteras

--Maruti top Nifty gainer on improved demand; Tata Motors fails to hold opening gains

--SBI rises 1% ahead of Q2 earnings

--RBL Bank, Shriram Transport, Bandhan, AB Fashion, Union Bank, DLF top midcap gainers

--PI Industries falls 7%

--Dabur ends flat amid volatility after strong Q2 show

--Sun Pharma reports better-than-expected earnings, stock ends flat

--Market breadth favours bulls; advance-decline ratio at 2:1

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Closing Bell | Sensex down 109 points at 60,029, Nifty50 gives up 17,900

The Sensex index fell 109.4 points or 0.2 percent to end at 60,029.1. The broader Nifty50 benchmark shed 40.7 points or 0.2 percent to settle at 17,889.

Losses in oil & gas, metal and select IT shares pulled the Nfity50 index lower. However, gains in construction, auto and select financial shares limited the downside. (Read more on the closing bell)

Union Bank of India Q2 | Net profit rises to Rs 1,526 crore, NII up 8.5%

The lender reported a net profit of Rs 1,526.1 crore for the quarter ended September. Union Bank of India had posted a net profit of Rs 515.6 crore for the corresponding period a year ago.

Its net interest income -- the difference between interest earned and interest paid -- increased 8.5 percent to Rs 6,829.3 crore.

Gross non-performing assets came in at 12.64 percent in Q2, as against 13.60 percent in the previous quarter. Net NPAs were at 4.61 percent in the September quarter, as against 4.69 percent in the previous three months.

Union Bank of India shares extended intraday gains after the earnings announcement. In late afternoon deals, the stock was up 5.6 percent at Rs 49.3 apiece on BSE.

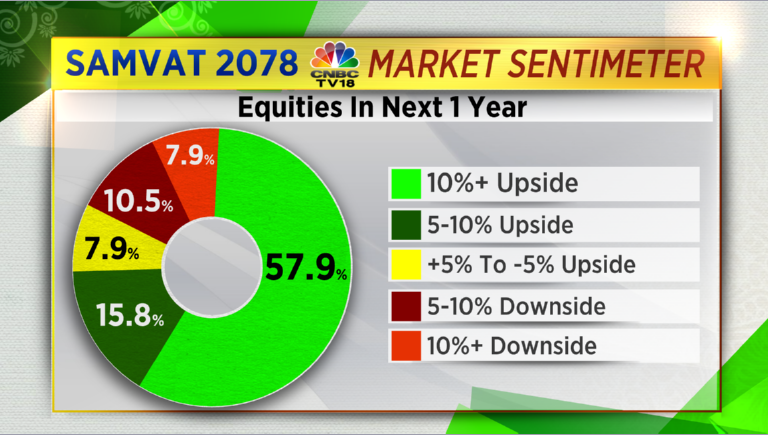

Raamdeo Agrawal says this has been defining year for market, phenomenal participation by retail investors

Market veteran Raamdeo Agrawal said in an interview to CNBC-TV18 that this has been a defining year for the market. There has been phenomenal

participation by retail investors, he said.

He believes the market will surprise on the upside.

JSPL Q2 | Revenue up 67% at Rs 13,612 crore, meets Street estimates

Jindal Steel & Power Ltd (JSPL) reported a net profit of Rs 2,584 crore for the quarter ended September 2021, as against Rs 836.6 crore for the quarter ended September 2020. Its revenue increased 67 percent on year to Rs 13,612 crore for the July-September period.

Analysts in a CNBC-TV18 poll had predicted the company's net profit at Rs 2,602 crore over revenue of Rs 13,856 crore.

JSPL shares traded two percent lower at Rs 422.5 apiece on BSE after the earnings announcement.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|