Steel stocks gained on Monday outperforming in an otherwise weak market as the reduction in prices of key raw materials boosted sentiment for the sector. Shares of JSW Steel, Jindal Steel & Power Ltd and Tata Steel gained by up to 3 percent in trade on Monday.

The sentiment turned positive as prices of iron ore and coking coal, key raw materials used in steel production, have fallen sharply in the last 10 days, while the reopening of Chinese cities after weeks of coronavirus-induced lockdowns improved the demand outlook.

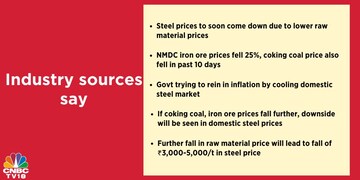

State-owned National Mineral Development Corporation (NMDC) has slashed iron ore prices twice in a span of 10 days, reducing its prices by around 25 percent, while the cost of coking coal has also softened by $80 in the past 10 days. Coking coal, also known as metallurgical coal, is used to create coke, one of the key irreplaceable inputs for the production of steel.

NMDC shares, however, slipped 4.5 percent as the price cut comes at a time when demand is expected to pick up as major Chinese cities reopen, dampening sentiment in the ore supplier stock.

The company's profits are set to be under stress after the government recently raised export duty on iron ore and now the price cut adds to woes. The January-March quarter results showed NMDC's operating margins had suffered sharp erosion owing to lower realisations and higher expenses. Even the Bank of America report had highlighted these concerns and pointed at significant downside risks.

Meanwhile, industry sources told CNBC-TV18 that the government is trying to rein in inflation by cooling the domestic steel market. A further fall in raw material price will lead to fall of Rs 3000 to Rs 5000 per tonne in steel price, they added.

Even though there was buying on the street, Dipan Mehta, Director, Elixir Equities is not “optimistic” about the sector.

“Correction in raw material prices certainly will benefit steel companies in managing their margins considering realisations are lower. But considering where these stocks are trading at this point of time, and volumes also are flattening out, the export opportunity is limited because of the export duty,” Mehta told CNBC-TV18.

A downturn in the commodity cycle could be detrimental, Mehta added.

“And with the way inflation is going and all the corrective action being taken, you could expect a downturn in the commodity cycle and that could be detrimental for steel stocks. So I would like to avoid steel stocks at this point of time.”

Hemang Jani, Retail Equity Strategist at Motilal Oswal Financial Services too feels that duty on exports will remain a dampener for steel stocks.

“Correction in input prices of steel does provide short term tactical up move for names like JSW Steel and few other companies because you might have a case where the spreads are looking a bit better than what they were few weeks back. However, given the fact that we have such an important decision on the duty front and the fact that prices could remain a bit subdued, I do not see a reason why we should have a very aggressive positive view on metals at this point of time. However because the sector has corrected, you might see a bit of pop here and there.”

First Published: Jun 6, 2022 2:58 PM IST