Shriram Transport Finance Company Ltd shares rose sharply on Friday, a day after the shadow bank reported a jump in profit along with improving net interest margin (NIM) as well as asset quality.

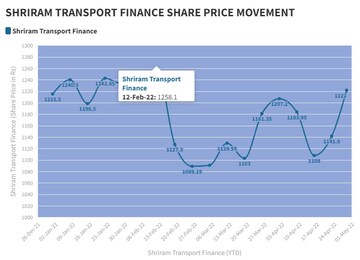

At 11:28 am, the Shriram Transport Finance Company stock was up seven percent at Rs 1,220 apiece, having risen to as high as Rs 1,228 apiece earlier in the day.

Despite a gain of almost of 12 percent in the last five days, the non-banking financial company's stock is down more than 14 percent in the past one year.

Market experts prefer value play in the shadow banking sector, according to Krishnan ASV, Lead Analyst-BFSI at HDFC Securities. "Even among institutional investors, there are the ones who look for value, who look for decent trades on the NBFC side," he said in an interaction with CNBC-TV18.

"Our own pecking order there, I think Shriram has reported strong numbers. The earnings call is ongoing right now, but I think there will be a tear there. The other NBFC we still see runway with is SBI Cards & Payment Services because Chola has already run up. We like CreditAccess Grameen's business but it has already run up as well. So among the stronger franchises, SBI Cards is the one where we still see enough leg room where there is a dislocation that is waiting for discovery,” he said.

Shriram Transport Finance reported a 43.87 percent jump in standalone profit after tax (PAT) to Rs 1,086.1 crore for the January-March period, as against Rs 754.93 crore for the corresponding period a year ago.

"The growth in profit was due to better NIM driven by lower cost of funds, and also as asset quality improved," said Umesh Revankar, Vice Chairman and Managing Director of Shriram Transport Finance.

The significant increase in economic activities after easing of COVID-related restrictions resulted in improvement in its business operations.

The company's NIM for the quarter ended March 2022 came in at 6.96 percent, as against 6.80 percent for the year-ago period. Its cost of borrowing reduced to 8.54 percent from 9.14 percent.

#4QWithCNBCTV18 | Shriram Trans reports Q4 earnings.

▶️Gross NPA at 7.07% vs 8.4% (QoQ)▶️Net NPA at 3.67% vs 4.36% (QoQ) pic.twitter.com/3IKF9n40t1— CNBC-TV18 (@CNBCTV18Live) April 28, 2022

Revankar expects the cost of borrowing to improve further in the first two quarters of the year ending March 2023.

(Edited by : Sandeep Singh)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 20% voter turnout recorded by 11 am

Apr 26, 2024 9:11 AM