Indian equity benchmarks tumbled on Monday dragged by a broad-based sell-off, as investors awaited the outcome of the RBI policy due this week. Both headline indices fell as much as 2.3 percent before recovering some of those losses.

The Sensex ended 1,023.6 points or 1.8 percent lower at 57,621.2 and the broader Nifty50 benchmark settled at 17,214, down 302.4 points or 1.7 percent from its previous close. Investors lost more than Rs 6 lakh crore in three back-to-back sessions as the market value of BSE-listed companies dropped to Rs 264.8 lakh crore.

During the session, the 30-scrip index plunged as much as 1,345.8 points and the 50-scrip benchmark to as low as 17,119.4, down 396.9 points from its previous close.

Broader markets walso weakened, with the Nifty Midcap 100 falling one percent and its smallcap counterpart finishing with a loss of 1.3 percent.

Tata Consumer, L&T, HDFC Bank, Britannia, HDFC Life, Bajaj Finance, HDFC and Hero MotoCorp, closing around 3-4 percent lower, were the worst hit among the 42 laggards in the Nifty50 pack.

On the other hand, PowerGrid, ONGC, Tata Steel, NTPC, SBI and Shree Cement, rising between 0.6 percent and 1.9 percent, were the top blue-chip gainers.

HDFC, HDFC Bank, Infosys, ICICI Bank and Larsen & Toubro were the biggest drags for both headline indices.

NSE's India VIX index -- known in market parlance as the fear gauge -- ended up 8.1 percent at 20.4, its biggest jump in two weeks.

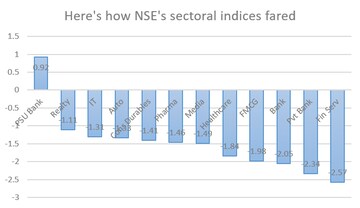

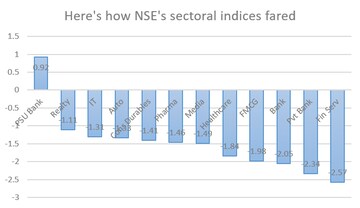

Barring the Nifty PSU Bank, all sectoral gauges on NSE suffered losses. The Nifty Bank and Financial Services indices were down two percent and 2.6 percent respectively.

The Nifty Bank, Private Bank and Financial Services indices were the worst hit among sectoral gauges, closing between 2.1 percent and 2.6 percent lower. The Nifty FMCG index fell two percent.

The PSU banking barometer bucked the trend, finishing 0.9 percent higher, led by SBI (up 0.6 percent) and Bank of Baroda (5.6 percent) after both reported strong financial results for the December quarter.

Godrej Properties' shares rose 3.7 percent after the real estate company cancelled plans to invest Rs 700 crore in DB Realty to acquire a 10 percent stake and set up a joint platform.

Around 130 stocks in the BSE 500 index -- the broadest gauge on the bourse -- finished in the green.

From the midcap and smallcap segments, Gujarat Narmada, CreditAccess, Gulf Oil, Shankara Building and Eveready, up 12-16 percent, were among the top gainers. On the other hand, Jubilant Life, Suntech Realty, DLink and Ujjivan Financial, down 6-10 percent, were among the losers.

Here are some key reasons behind the crash on Dalal Street:

Nervousness on interest rates

: The RBI is due to conduct its bi-monthly policy review this week. The central bank's meeting comes at a time when the Bank of England has hiked key rates for a second straight time and accelerating inflation stoked concerns about aggressive tightening by the Fed. The US central bank has already lined up rate hikes this year.

Inflation: Major central banks aim to tame inflation. contain inflation as they Business in India and the world have been struggling against higher input costs. Central banks use higher interest rates as a means to control inflation by slowing down the flow of money.

Foreign fund outflows: Foreign institutional investors have net sold Indian shares worth Rs 36,930 crore ($4.9 billion) so far in 2022, according to provisional exchange data. In October through December, they pulled out a net Rs 38,521 crore ($5.1 billion) from Indian equities. Less liquidity in global markets could reduce allocations by foreign investors to markets, including India.

Overheated valuations: Foreign brokerages, the RBI and many market experts have been warning of high valuations in Indian shares.

Until late October 2021, the Indian market had seen a near one-sided rally driven by liquidity. In 2022 so far, headline indices have come within 1.5 percent of those highs but only to retreat to lower levels.

Crude: High oil prices continue to spook investors. Benchmark Brent futures are hovering near a seven-year peak above $93 per barrel, boosted by tight global supply and steady improvement in fuel demand from the pandemic lows.

COVID-19: Worries about the pandemic persist among investors. Though there is a fall in new infections in many parts of the country, news updates on the pandemic are keeping investors on the back foot.

Global markets

European shares gave up initial gains. Although strong US jobs data aided investor sentiment, concerns about diplomatic tensions remained a worry as the White House warned Russia could invade Ukraine any day. The Pan-European Stoxx 600 index fell as much as 0.2 percent in early hours.

S&P 500 futures were down 0.2 percent, suggesting a muted start ahead on Wall Street.

(Edited by : Akanksha Upadhyay)

First Published: Feb 7, 2022 3:08 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM