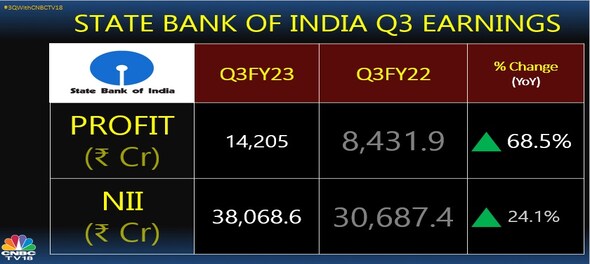

State Bank of India (SBI) quarterly profit surged 68.5 percent to a record high of Rs 14,205 crore, boosted by better interest income and a drop in bad loan provisions. The lender reported a healthy performance for the third quarter on the operating front, driven by net interest margin (NIM) expansion and higher other income, analysts said. Brokerages welcomed the results and gave 'buy' to 'overweight' rating.

Here's how different brokerage houses reacted:

Morgan Stanley

Morgan Stanley (MS) gave an 'overweight' rating on SBI and said that their Q3 PAT was above estimate led by higher improvement in margin and low non-performing asset (NPA) related provisions. Loan growth and asset quality were strong, it added.

JPMorgan On SBI

JP Morgan gave an 'overweight' rating and kept target price at Rs 720 per share. It said that Q3 net profit exceeded Street expectations, while delivering across all metrics. The core Pre-provision operating profit (PPOP) rose and was better than most private banks, it said.

Net slippages were minimal during the quarter, it added.

Pre-provision operating profit (PPOP) is the amount of income that a financial institution, usually a bank, earns in a given time period before subtracting funds set aside to provide for future bad debts.

Jefferies On SBI

Jefferies gave a 'buy' rating on SBI and kept target price at Rs 760 per share. The profit surpassed Street estimates with stronger net interest income (NII) and market-to-market (MTM) gains. The free growth at 3 percent and Current Account and savings account (CASA) growth at 6 percent remained soft, it said. It further said that gross non-performing loan (NPL) fell to 3.1 percent of loans with coverage at 76 percent and buffers at 0.3 percent of loans.

MTM refers to the realistic estimate of the financial situation of the market depending on the assets and liabilities present.

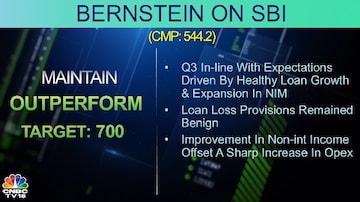

Bernstein On SBI

Bernstein gave an 'outperform' rating on SBI and said that Q3 was in-line with expectations driven by healthy loan growth and expansion in NIM. Loan loss provisions remained benign, it said.

It kept target price at Rs 700 per share.

Nirmal Bang Institutional Equities

Nirmal Bang Institutional Equities gave a 'buy' rating and kept target price at Rs 667 per share. It said that the management is confident that lower deposit Asset quality continued to show improvement on the back of higher write offs. The bank registered RoA/RoE at almost a decade high of 1.1 percent/18.2 percent, it said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM