It was a bloodbath on Dalal Street on Thursday with headline indices Sensex and Nifty50 taking their biggest hit since May 2020 amid a global sell-off, after Russia launched a military operation in Ukraine. Crude oil skyrocketed to fresh seven-year peaks.

The 30-scrip index nosedived 2,702.2 points or 4.7 percent to end at 54,529.9 and the broader Nifty50 benchmark crashed to 16,248, down 815.3 points or 4.8 percent -- their biggest single-day plunge since May 4, 2020.

ALSO READ

Russian President Vladimir Putin claimed the move is intended to protect civilians and is in response to threats coming from Ukraine. He warned other countries that any attempt to interfere with the Russian action would lead to consequences.

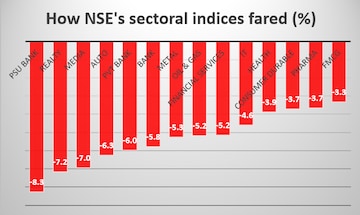

All sectors as well as broader market gauges bore the brunt of a prevalent panic among investors.

| Index | Change (%) |

| Sensex | -4.7 |

| Nifty50 | -4.8 |

| Nifty Midcap 100 | -6.2 |

| Nifty Smallcap 100 | -5.7 |

The India VIX - known in market parlance as the fear index - finished the day 32 percent higher at 30.3, having climbed to almost 34 during the session. That was its biggest surge since June 17, 2020 - both intraday and at the close.

All of the 50 Nifty scrips settled in the red, with Tata Motors, IndusInd, UPL, Grasim, JSW Steel, Adani Ports and BPCL being the worst hit.

"Besides the Russia-Ukraine crisis, there could be multiple reasons for nervousness among market participants, including the F&O expiry, soaring crude oil rates, imminent Fed rate hikes, state elections and the new margin system," AK Prabhakar, Head of Research at IDBI Capital Markets, told CNBCTV18.com.

Here are some key factors running high on investors' minds:

First Published: Feb 24, 2022 3:00 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh: Kuppam loyalty test for TDP chief Chandrababu Naidu

May 6, 2024 9:35 AM

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM