Rossell India, a prominent player in the tea and aviation industries, has witnessed significant growth in recent months. The company's stock has experienced a substantial surge of around 3-3.5 percent on June 20, 2023. However, this gain pales in comparison to the impressive upward trend the stock has shown throughout the month, with an increase of approximately 22.5 percent. Looking back over the past year, Rossell India's stock price has more than doubled. Moreover, the company's success is amplified by the surge in trading volume, indicating strong market interest.

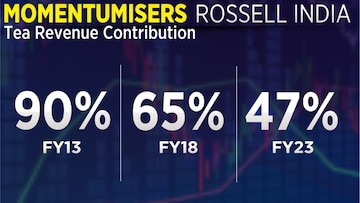

Rossell India operates through two distinct revenue streams, black

tea and aviation products and services. While both sectors contribute to the company's success, recent trends reveal a diversification in revenue sources. Historically, tea accounted for nearly 90 percent of Rossell India's sales in FY13.

However, in a remarkable transformation, tea's share has now decreased to less than half of the company's total sales.

Conversely, the

aviation business has experienced significant growth in revenue contribution. In FY19, aviation accounted for Rs 100 crore, and this figure has climbed to approximately Rs 186 crore in FY23.

Rossell India's ability to adapt to market dynamics and shift its focus toward a flourishing aviation sector has proven instrumental in driving its success.

Rossell India's growth story is further reinforced by its improving financial position. The company's debt, which stood at Rs 195 crore a few years ago, has been significantly reduced to just under Rs 150 crore as of the latest reported figures.

The promoters of Rossell India continue to play a vital role in its operations, holding a substantial 75 percent stake in the company. However, institutional shareholding has also seen a noteworthy increase, rising from zero as of September 2021 to over 4 percent in the latest reported data.

Several key factors are expected to drive Rossell India's future growth. The company's aviation business, which primarily operates outside the country, presents an exciting opportunity for increased contribution. The growth potential in domestic maintenance repair and overall aviation services is a key area to monitor closely, as it could significantly boost Rossell India's revenue and profitability.

Furthermore, the potential demerger of Rossell India's two divisions holds the key to unlocking substantial value.

For more details, watch the accompanying video