Canara Bank shares remained in focus on Wednesday after shareholding data showed ace investor Rakesh Jhunjhunwala picked a stake in the state-run lender. With the latest addition, the Big Bull has put at least three banking stocks in his portfolio, including Federal Bank and Karur Vysya Bank.

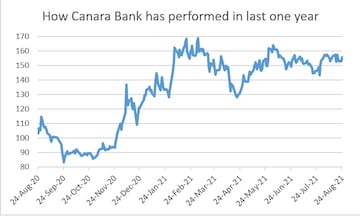

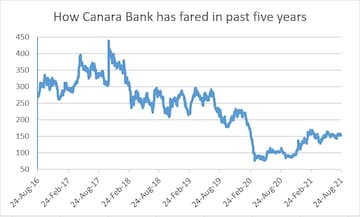

Canara Bank shares have given a return of about 21 percent to investors so far in 2021, having bounced back 92 percent since the lockdown lows of March 2020. The PSU lender's stock has beaten benchmark index Nifty50's 19 percent return, as well as the sectoral gauge Nifty Bank's (14 percent).

Jhunjhunwala now holds a 1.59 percent stake in Canara Bank, according to a shareholding statement released on August 24.

His bet on Canara Bank comes months after Jhunjhunwala, often referred as the Big Bull in the market, indicated that he is bullish on banks, even the so-called inefficient ones, saying that the (non-performing asset) NPA cycle had turned.

So what attracts the legendary investor to Canara Bank shares now?

Profit growth

For the quarter ended June 30, Canara Bank reported 189.8 percent year-on-year and 16.5 percent sequential jump in net profit to Rs 1,177.47 crore, helped by higher non-interest income and a fall in provisions for non-performing assets (NPAs).

Its profit growth was better compared to state-run peers SBI and Bank of Baroda, but worse than PNB.

How Canara Bank fares among peers

Gross NPAs

In terms of gross NPAs, Canara Bank stands at the fifth position, after SBI, PNB, Union Bank of India and Bank of Baroda.

| GNPA (Rs, cr) | Q1FY22 | Q1FY21 | Q4FY21 | YoY | QoQ |

| SBI | 134259.48 | 129660.69 | 126389.02 | 3.5 | 6.2 |

| PNB | 104075.56 | 101849.34 | 104423.42 | 2.2 | (0.3) |

| Union Bank of India | 87762.19 | 97190.00 | 89788.20 | (9.7) | (2.3) |

| Bank of Baroda | 63028.78 | 69132.01 | 66670.99 | (8.8) | (5.5) |

| Canara Bank | 58215.46 | 57525.52 | 60287.84 | 1.2 | (3.4) |

| Bank of India | 56041.63 | 57787.78 | 56534.95 | (3.0) | (0.9) |

| ICICI Bank | 43148.28 | 40386.24 | 41373.42 | 6.8 | 4.3 |

| Indian Bank | 37759.18 | 39965.02 | 38455.35 | (5.5) | (1.8) |

| IDBI Bank | 35593.86 | 44475.20 | 36211.95 | (20.0) | (1.7) |

| YES Bank | 28,506.0 | 32,702.7 | 28,609.5 | (12.8) | (0.4) |

Net NPAs

On the net NPAs front, Canara Bank ranks fourth, after SBI, PNB and Union Bank of India.

| NNPA (Rs, cr) | Q1FY22 | Q1FY21 | Q4FY21 | YoY | QoQ |

| SBI | 43152.52 | 42703.63 | 36809.72 | 1.1 | 17.2 |

| PNB | 38580.58 | 35303.02 | 38575.70 | 9.3 | 0.0 |

| Union Bank of India | 27437.45 | 28914.00 | 27280.62 | (5.1) | 0.6 |

| Canara Bank | 22434.06 | 24355.23 | 24442.07 | (7.9) | (8.2) |

| Bank of Baroda | 20259.97 | 19449.68 | 21799.88 | 4.2 | (7.1) |

| Indian Bank | 12652.87 | 12754.74 | 12271.13 | (0.8) | 3.1 |

| Bank of India | 12424.13 | 13274.95 | 12262.03 | (6.4) | 1.3 |

| YES Bank | 9,454.9 | 8,157.5 | 9,813.4 | 15.9 | (3.7) |

| ICICI Bank | 9305.83 | 8674.65 | 9180.20 | 7.3 | 1.4 |

| Central Bank of India | 7904.03 | 11440.59 | 9036.46 | (30.9) | (12.5) |

Loan book

Canara Bank has the fifth biggest loan book among lenders.

| Loan Book (Rs, cr) | Q1FY22 | Q1FY21 | Q4FY21 | YoY | QoQ |

| SBI | 2523793.00 | 2385639.00 | 2539393.00 | 5.8 | (0.6) |

| HDFC Bank | 1147651.64 | 1003298.86 | 1132836.63 | 14.4 | 1.3 |

| ICICI Bank | 738597.86 | 631214.64 | 733729.09 | 17.0 | 0.7 |

| Bank of Baroda | 711487.00 | 736547.00 | 751590.00 | (3.4) | (5.3) |

| Canara Bank | 684585.00 | 650574.00 | 675155.00 | 5.2 | 1.4 |

| PNB | 661288.60 | 702129.00 | 674230.08 | (5.8) | (1.9) |

| Union Bank of India | 645091.00 | 650127.00 | 653684.00 | (0.8) | (1.3) |

| Axis Bank | 614873.69 | 548845.51 | 614399.40 | 12.0 | 0.1 |

| Indian Bank | 389625.00 | 366787.00 | 390317.00 | 6.2 | (0.2) |

| Bank of India | 370607.26 | 370614.56 | 365686.52 | (0.0) | 1.3 |

Gross NPAs as percentage of total loans

Its gross NPAs as a percentage of total loans (8.50 percent) were better than PNB (14.33 percent) and Bank of Baroda (8.86 percent) in Q1, but much worse than SBI (5.32 percent).

Net NPAs as percentage of total loans

In terms of net NPAs as a percentage of the loan book, Canara Bank (3.46 percent) fared better than PNB (5.84 percent), but much worse than SBI (1.77 percent).

(Edited by : Ajay Vaishnav)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

OPINION | Can markets predict elections? Applying the 2019 test

May 10, 2024 12:49 PM

Colour-coordinated theme-based polling booths set up in Srinagar

May 10, 2024 9:26 AM

Haryana: 16 women among 223 candidates in fray for 10 Lok Sabha seats

May 10, 2024 9:04 AM