With the market recovering from the carnage in the year's beginning, Yes Securities has replaced HCL Technologies with Repco Home Finance in its portfolio.

Speaking on the rationale of picking a small-cap financier, the brokerage explained that Repco Home Finance has a strong balance sheet with no exposure to construction finance. In fact, 80 percent of its portfolio is occupied with home loans with 26 percent for robust Tier-1 capital, it said.

The financier did not take any loan moratorium from its lenders. Additionally, it has also received large funding sanctions from SBI and National Housing Bank at lower rates, added the brokerage report.

Yes Securities believes that impairment of net worth is unlikely even in a worst-case scenario given that PPOP margin is around 3.5 percent. Therefore, the current valuation offers a good opportunity, it said.

The brokerage excluded IT giant HCL Technologies from its model portfolio due to the recent profit booking at higher valuations. It also feels that the stock has shifted to high beta names.

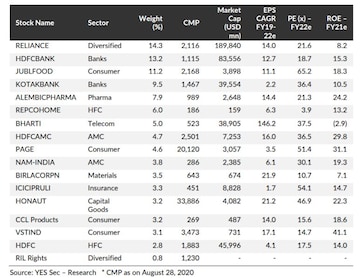

In June, the domestic brokerage had included Honeywell Automation and VST Industries, while reduced the weightage of Reliance Industries in its portfolio.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 60% voter turnout recorded by 5 pm

Apr 26, 2024 9:11 AM