Shares of PI Industries slumped as much as 8 percent on Tuesday after the company said that the business transfer agreement (BTA) with Ind Swift Laboratories Ltd stood terminated.

At 10:25 am, shares of the company were down 7.5 percent at Rs 2,771 on the BSE. The stock had opened with a loss of 5.2 percent today. The stock was the worst hit on the Nifty500 index.

The business transfer agreement between PI Industries and Ind Swift Laboratories Ltd and its promoters, was for the acquisition of the latter’s API business division by way of a slump sale on a going concern basis.

Also Read |

Given the non-fulfilment and disagreement on some of the pre-agreed conditions, PI Industries decided not to further pursue the transaction.

“The consummation of the transaction was subject to fulfilment of pre-defined conditions precedents before the Long Stop Date of October 31, 2021. Since ISLL has not been able to complete several of these pre-agreed conditions precedents, the BTA stands terminated,” the company said in an exchange filing.

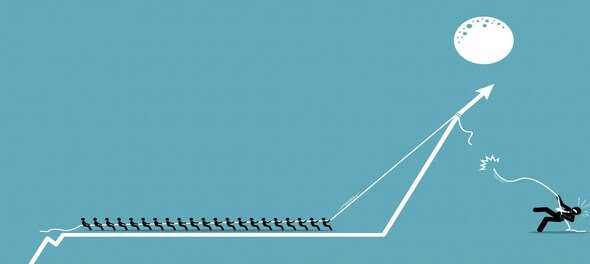

The termination of the business transfer agreement wrecked the sentiment for the stock as delay in allocation towards pharmaceutical venture has dragged return rations, some analysts said.

“The company had raised QIP money since last two years, however, delay in the allocation towards pharma venture has dragged return ratios,” said ICICI Securities.

“Since the due diligence for acquisition takes time, we expect a delay in finding out the right candidate for inorganic expansion can impact return on investments in the near term, however, the long term story remains intake about the development of pharma CDMO business,” the brokerage added.

The company’s strategy to strengthen its presence in custom synthesis exports through diversification into adjacencies including pharmaceutical remains intact.

The company will continue to evaluate other merger and acquisition opportunities that are aligned to its strategic goal, PI Industries added.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024 Phase 5: 37% voter turnout recorded till 1 pm, highest in Ladakh at 52%

May 20, 2024 10:30 AM

Lok Sabha Election 2024: Is it mandatory for employers to give paid holiday on voting day? | Explained

May 20, 2024 10:07 AM

Lok Sabha Elections 2024 | How critical is Phase-5 for both NDA and I.N.D.I.A

May 20, 2024 7:30 AM