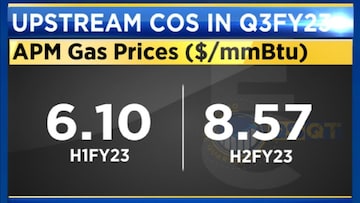

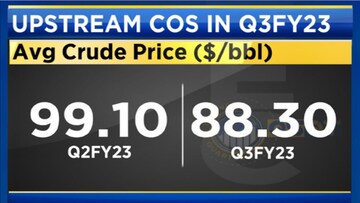

It has been a double-whammy for gas utility companies. On one hand, the gas demand is on the weaker side and on the other, there is a supply shortage. Moreover, higher pricing could also impact earnings.

However, ICICI Securities' Energy Analyst Probal Sen is of the view that Reliance Industries Ltd (RIL) can show a better growth in the third quarter. Sen told CNBC-TV18 that overall Reliance can show better growth in terms of Jio, retail and the oil and gas business. On an overall basis, compared to quarter two, quarter three would look better and quarter four would probably show better growth for Jio and Retail, he said.

Sen remains fairly bullish on the gas utility space from a long-term perspective.

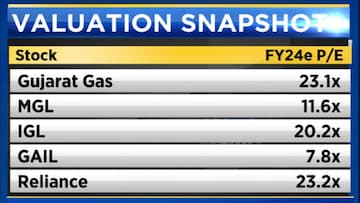

“From a valuation perspective, GAIL, Petronet LNG and Gujarat State Petronet Ltd (GSPL) appear to be very comfortable. They are fairly robust and solid businesses, we remain fairly bullish on the space from a long-term perspective,” he said.

According to him, GSPL is a good play and would standout for the next 12 months in this space. For a long time, the stock has suffered because of concerns around tariffs being cut substantially. With the change in regulations, he believes tariffs will be cut negligibly which will favour GSPL.

He believes GAIL will remain under pressure in the short-term, in the next 9-12 months because of lower gas volumes, petrochemical and utilization has taken a hit.

For Petronet LNG, earnings have bottomed out, utilization can only go up from here steadily given the fact that LNG prices have not spiked in the winter as was being expected because of favourable weather in Europe as well as demand pressure from China.

In terms of city gas distribution (CGD) companies, he believes that the pass through of costs and lower liquefied natural gas (LNG) prices will mute margin impact on CGDs.

“The margin hit is not as drastic as one would expect and in fact the impact is mixed,” he said.

The quarter on quarter (QoQ) decline in Indraprastha Gas Ltd (IGL) and Mahanagar Gas Ltd (MGL) is more in terms of mid-single digits, whereas for Gujarat Gas its volume hit translated into more than 29 percent QoQ decline in its overall profitability.

He believes the numbers still appear better on year on year (YoY) basis because the base was weak same quarter last year.

Despite all the kind of price increases CGD companies have done and a relative competitiveness narrowing to petrol and diesel, volume growth still continues to be fairly resilient for IGL in particular and MGL to a lesser extent, he added.

The industrial volumes for Gujarat Gas are struggling to compete with propane right now, which is a bit of a worry in the near-term to medium-term, he said.

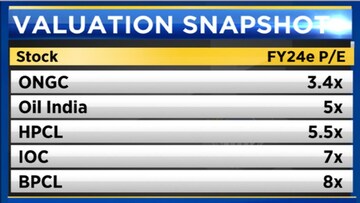

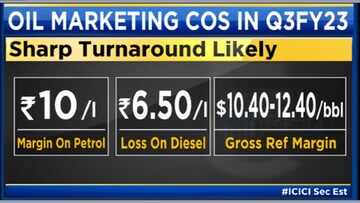

Among the state-run oil marketing companies (OMCs), Hindustan Petroleum Corporation Ltd (HPCL),

Bharat Petroleum Corporation Ltd (BPCL) and Indian Oil Corporation (IOC), IOCL is the preferred pick for Sen.

“Because they have a favourable refining to marketing mix and therefore losses in one segment can be offset by gains in the other depending on which way the pricing and margins move,” he said.

Disclosures: RIL, the promoter of Reliance Jio, also controls Network18, the parent company of CNBCTV18.com.

For the entire interview, watch the accompanying video

(Edited by : C H Unnikrishnan)