Shares of Muthoot Finance fell over 9 percent in early trade on Friday as investors expressed disappointment with the company post its earnings, owing to a miss on all metrics.

At 11.26 am, the stock was trading at Rs 1,089.05, parring a chunk of its initial losses, down 4.25 percent or Rs 50.30 on the BSE. The shares of the company have underperformed the sector by 5.74 percent.

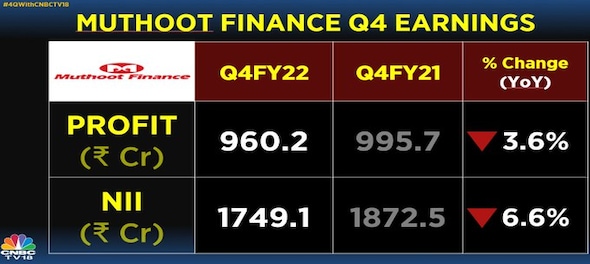

Muthoot Finance on Thursday reported a marginal decline in its consolidated net profit at Rs 1,006.23 crore for the quarter ended March as core interest income fell.

The non-banking finance company, mainly into gold loan services, had registered a net profit of Rs 1,023.76 crore in the same period a year ago.

As per a poll by CNBC-TV18, the Street had pegged the company's profit at 1,036.8 crore and NII at Rs 1,964.6 crore for the March ended quarter.

Despite the profit and NII miss, Muthoot Finance, the country's largest gold loan non-banking financial company (NBFC), saw its consolidated loan assets under management (AUM) increase to Rs 64,494 crore as of March 31, 2022, up by 11 percent from the same period a year ago. The gold loan AUM also saw a growth of 11 percent in FY22.

George Alexander Muthoot, Managing Director of Muthoot Finance, believes gold loans are a great option, both in times of rise and drop in economic activity.

In an interview with CNBC-TV18, he said that gold loan growth will be at 12-15 percent for FY23.

He explained that going ahead, he expects to maintain net interest margin (NIM) between 10-11 percent, estimating a slight dip in the next quarter as compared to 12.21 percent in Q4FY22.

"We usually talk about the spreads (NIM), which at the best of times came at 13-14 percent. But we would like the spread to be in the region of 10 to 11. Between 10 and 11 is what we should be expecting, and that will remain there probably next quarter. We will be able to retain the 10 to 11 percent. I think that's a reasonable NIM compared to the situations today," he said.

The company also said that it has declared a dividend of 200 percent on face value of shares of Rs 10 each, involving a payout of Rs 803 crore.

(With agency inputs)

First Published: May 27, 2022 1:57 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Colour-coordinated theme-based polling booths set up in Srinagar

May 10, 2024 9:26 AM

Haryana: 16 women among 223 candidates in fray for 10 Lok Sabha seats

May 10, 2024 9:04 AM