Shares of MRF crossed the Rs 1 lakh mark in today's trading session, becoming the first Indian company to do so in absolute value terms. The stock made an intraday high of Rs 1,00,439 on Tuesday.

The tyre manufacturer has now gained 900 percent from the time it first crossed the mark of Rs 10,000 on February 21, 2012.

It has taken the stock more than two years to reach Rs 1 lakh from Rs 90,000. The stock had closed above the mark of 90,000 for the first time on January 20, 2021. It made its previous record high of Rs 99,933 on May 8.

MRF has been paying dividends but has never issued a bonus share or carried out a stock split. It recently declared a final dividend of Rs 169 per share, taking the total dividend payout for financial year 2023 to Rs 175.

The tyre manufacturer reported a net profit of Rs 410.7 crore for the March quarter, a growth of 161.5 percent from last year, compared to Rs 157 crore.

MRF’s earnings before interest, taxes, depreciation, and amortisation or EBITDA of Rs 843.1 crore in the quarter under review was 59.8 percent higher than Rs 527.6 crore reported in the quarter ended March 2022.

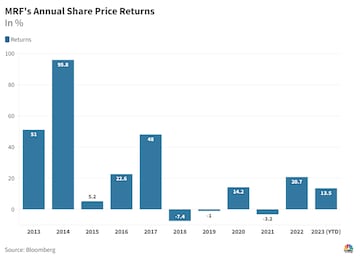

Between 2013-2017, shares of MRF delivered positive annual returns for five years in a row. After gaining 20 percent in 2022, shares are up another 12.7 percent so far in 2023.

In comparison, peers like Apollo Tyres and Ceat have outperformed MRF in absolute share price returns on a year-to-date basis, while others have lagged.

It needs to be brought to notice that shares of MRF are illiquid and do not have significant trading volumes on a daily basis. Daily average of shares traded over the last 20 sessions ranges on both BSE and NSE is close to 8,600 shares.

Despite this surge in share price, 10 out of the 12 analysts that track MRF have a sell recommendations.

A note from Elara Capital stated that MRF's revenue share has remained largely intact among peers, contradictory to other leaders in consumer-facing businesses.

"MRF’s revenue stream is diversified across the segments, making it less vulnerable to slowdown in a particular segment. It also enjoys strong balance sheet strength," Elara Capital said in its note.

Incidentally, Elara is one of the brokerages that do not have a sell rating on MRF. It raised its price target on the stock to Rs 1 lakh.

On the other hand, Motilal Oswal has a sell rating on MRF, saying that the company's competitive positioning has weakened within the sector within the past few years, which is also being reflected in the dilution of pricing power.

"This, coupled with the impact of capex to be carried out, should result in limited expansion in return ratios," the note said.

MRF's current valuation is almost a premium of 100 percent to its peers, said Motilal Oswal in its note. It has a price target of Rs 75,000 on the stock.

Kotak Securities has the lowest price target on the street for MRF, at Rs 66,000.

First Published: Jun 13, 2023 9:26 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM