Motherson Sumi Wiring India Ltd. is in focus on Thursday after global markets research firm Nomura initiated coverage on the stock with a ‘buy’ rating.

Nomura gave a price target of Rs 62 on the stock, indicating a potential upside of 19.2 percent from Wednesday's closing price of Rs 52.

Motherson Sumi Wiring India is a leading, full-system wiring harness solutions provider in India supplying wiring harnesses to automotive original equipment manufacturers (OEMs).

The report added that the rising SUV mix and electrification with more features in vehicles will drive stronger value growth for Motherson Sumi Wiring.

Nomura also believes that Motherson Sumi Wiring would benefit from Sumitomo’s leadership in the high voltage segment in Japan. The company gets technology expertise from Sumitomo Wiring Solutions (SWS), which holds nearly 25 percent stake in the company and is a global leader in wiring harness.

“SWS, a leader in Japan's high-voltage cables segment, is already mass-producing many components and expects its EV revenue share to reach more than 60 percent by 2030 (from 25 percent in the fiscal year 2022). We believe this will help Motherson Sumi Wiring to capitalise on EV opportunities. In the medium term, we expect Motherson Sumi Wiring to localise and improve profitability in the segment,” the report said.

On the flip side, Nomura warned that since Motherson Sumi Wiring is dependent on the performance of the Indian automotive sector, downside risks can include lower consumer sentiment in passenger vehicles, delayed demand, or a change in government regulations.

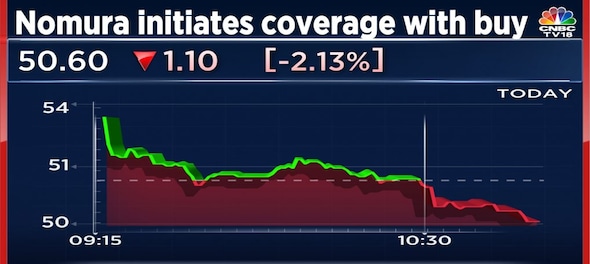

Shares of Motherson Sumi Wiring are trading 2.13 percent lower at Rs 50.60.