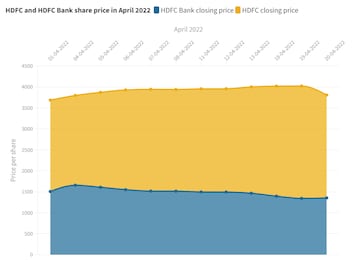

Shares of HDFC Bank and Housing Development Finance Corporation (HDFC) - popularly known as the HDFC Twins - have been at the receiving end of the recent market sell-off. Market estimates suggest that FIIs have sold HDFC Bank shares worth $3 billion in April so far as concerns stem from the proposed HDFC-HDFC Bank merger.

Add to it, the Street buzz on comparisons with ICICI Bank and shifting preference in the banking pack.

Yet there are strong believers in the HDFC twins franchise in the market and see the two stocks as a good long-term bet. Marcellus Investment's Saurabh Mukherjea isn’t amused with either market sell-off or comparisons with ICICI Bank. Staying positive on both HDFC Bank and HDFC, Mukerjea says we invest in a business and don’t lose any sleep thinking about stock price movements.

“We don't spend time thinking about stock price movements. We do a lot of work on underlying businesses and HDFC Bank’s last five years have been spectacular. You got to be looking at a class business,” Mukherjea told CNBC-TV18.

HDFC Bank vs ICICI Bank debate

On ICICI Bank vs HDFC Bank, Mukherjea said, "I'm not saying ICICI Bank is doing anything less than impressive. I think Sandeep Bakhshi has done a tremendous job at ICICI Bank. But HDFC Bank's delivery over the last five years, over the last 10 years, over the last 20 years has been in a different league to any other bank, even in the last three years, let alone five years, even in the last three years, you cannot see any other bank blazing away like this, both sides of the balance sheet, superb asset quality control, great RoEs, nobody else compares."

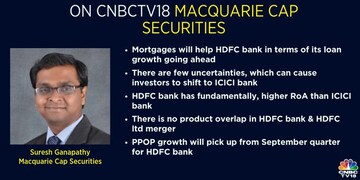

Macquarie's Suresh Ganapathy maintains that HDFC Bank is a good long-term bet adding that there is merit in buying ICICI Bank in the near term.

"In the near term, there is more merit to perhaps buy ICICI because there is less noise there. Let me put it this way, there is MSCI index rebalances and Nifty rebalances, and then you will also have other challenges with respect to the approvals from the Reserve Bank of India on what shape and size and format of the merger. So those kinds of uncertainties are there and people can argue that we just don't want to live through this uncertainty and move towards ICICI Bank," he told CNBC-TV18.

On the valuation front, Ganapathy said that HDFC Bank still remains a good bet for the long term.

"Both HDFC and ICICI are trading at the same valuation of about 2.3-2.4. At the same valuation, HDFC Bank still structurally has a 20 to 30 basis point higher ROA than ICICI Bank. So to that extent, you are getting into a stock that fundamentally has a higher ROA than ICICI or for that matter, any of the other banks in the system, but is available at the same valuation. Therefore, I am still willing to place a bet on HDFC Bank over the longer term."

HDFC twins meltdown - A buying opportunity?

Marcellus' Mukherjea sees the

HDFC-HDFC Bank merger as positive and says he's buying more amid the current round of correction in HDFC twins. From a high of Rs 1650 a day after the merger announcement, the HDFC Bank stock has fallen to a low of Rs 1,350 this week.

"You're bringing together two good businesses. It doesn't take a genius to figure out that the acquisition, the merger is RoA accretive, bringing into the two businesses which will together have comfortably a 2 percent RoA and it is EPS accretive. The NIMs will go down because mortgages tend to have lower NIMs but that's not surprising. It's RoA accretive and EPS accretive because you're bringing together two very profitable businesses. So two good franchises coming together, your RoE goes up, your growth goes up, I don't see why we shouldn't be buying more. In fact, we are buying more as we speak."

At 2.54 pm, HDFC Bank's share price traded at Rs 1,375.55 on NSE, up 1.6 percent. The stock has corrected 8 percent in the last month, while the three-year return on the stock is almost 20 percent.

HDFC share price quoted at Rs 2,231, up 2.33 percent on NSE. The stock has corrected 14 percent so far this year, while the three-year return on the stock is over 11 percent.