Axis Securities expects Maruti Suzuki India to recover on the margin and market share front in FY23 and FY24, led by a favourable product mix and lifecycle, operating leverage, and cost-cutting.

The brokerage house expects margins to be supported by strong demand, softening commodity inflation, and improving chip shortage situation. This comes at a time when most corporates are facing inflationary woes, which have kept their margins under pressure.

Axis Securities, however, sees the firm's margin falling quarterly due to higher steel, aluminium and copper prices but expects it to normalise from the second half of FY23. The auto major’s operating margin has risen to 9.1 percent in the fourth quarter of FY22 and the management has guided for the margin to bounce back to double-digits.

Earlier this month, Shashank Srivastava, Executive Director at Maruti Suzuki India, told CNBC-TV18: “We have not really fully covered for the increased commodity prices, even with a 10 percent increase." He said the material cost is 75-78 percent of the cost structure of an auto original equipment manufacturer, and,a change in commodity prices has a large impact.

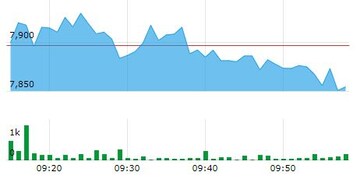

Axis Securities has a ‘buy’ call on the stock with a target price of Rs 8,500, which means an 8 percent upside from the current market price. At 10:00 am, shares of the automobile company were trading 0.6 percent lower at Rs 7846.6 on BSE.

Maruti Suzuki India's stock movement so far today. The scrip touched an intraday low of Rs 7,844.9 on the BSE. (Source: BSE)

Maruti Suzuki India's stock movement so far today. The scrip touched an intraday low of Rs 7,844.9 on the BSE. (Source: BSE)The stock has merely risen 6 percent year-to-date compared to Nifty50's 7 percent drop.

The domestic brokerage house says Maruti Suzuki, the leader in the domestic passenger car industry with a market share of about 45 percent, is a good buy. Besides, the company is likely to gain more market share, driven by an expected shift towards petrol and CNG vehicles, it said.

Talking about the export business, the opportunity continues to be lucrative, and the company’s renewed efforts are working out very well, said Axis Securities.

First Published: May 24, 2022 11:01 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Rahul Gandhi deserted Amethi due to fear of Smriti Irani': How BJP plans to puncture Congress' UP plan

May 3, 2024 1:12 PM

'Don't be scared, don't run away', PM Modi tells Rahul for not contesting from Amethi

May 3, 2024 1:06 PM