Home

Terms and Conditions

Closing Bell: Sensex, Nifty end with modest gains ahead of Union budget, Yes Bank dips 3.5%, Titan down 2.6%, UPL up 7.6%

Live Updates

Closing Bell: Sensex, Nifty end with mild gains ahead of Union budget##Closing Bell: Sensex, Nifty end with mild gains ahead of Union budget

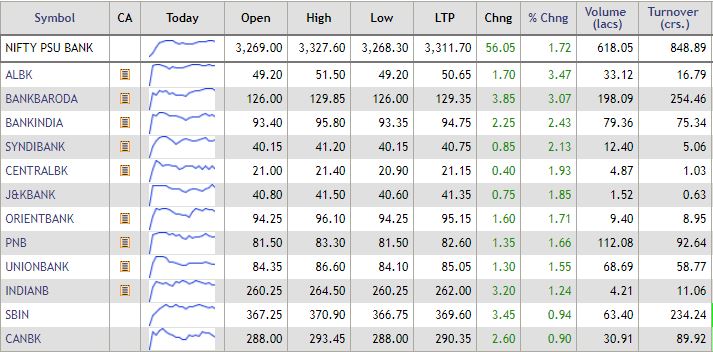

Benchmark indices ended with marginal gains in a volatile trade on Thursday ahead of Union Budget to be presented on July 5. The Sensex settled 68.81 points up at 39,908.06, higher by just 0.17 percent, while Nifty was up 21.20 points at 11,938, rising 0.25 percent. Broader markets ended lower with the Nifty MidCap down mildly by 0.03 percent. Among sectors, except metal and pharma all other indices ended higher led by the PSU bank, auto, FMCG, energy, IT, and infra. UPL, Bharti Airtel, UltraTech Cement, Britannia Industries and Tata Motors were among major gainers on the Nifty, while losers were Yes Bank, Tata Steel, Titan Company, Zee Entertainment and JSW Steel.

Key Asian indices end mixed on US Fed rate cut hope##Key Asian indices end mixed on US Fed rate cut hope

Asian indices ended on a mixed note as hope of an interest rate cut from the US Federal Reserve partially offset concern over whether the US and China would reach a durable trade deal. Investors also remained on the sidelines ahead of the US Independence Day holiday today. South Korea's Kospi ended higher by 0.61 percent, Japan's Nikkei 0.3 percent and Hong Kong's Hang Seng dipped 0.21 percent.

Budget 2019: Govt likely to stick to 3.4 percent fiscal deficit target, says Motilal Oswal##Budget 2019: Govt likely to stick to 3.4 percent fiscal deficit target, says Motilal Oswal

Manish Sonthalia, head equities- PMS at Motilal Oswal Asset Management Company, spoke to CNBC-TV18 about market fundamentals and shared budget expectations. On the Union Budget, he said, "If there was some help coming in for agri space then that would translate into consumption. Addressing rural distress is more important now that we may be looking at the monsoon deficit situation, so any kind of support would relieve the pain for the rural sector." READ MORE

Nifty could rise 12-15% over the medium term, says Sampath Reddy of Bajaj Allianz Life Insurance##Nifty could rise 12-15% over the medium term, says Sampath Reddy of Bajaj Allianz Life Insurance

Sampath Reddy, chief investment officer of Bajaj Allianz Life Insurance expects corporate earnings growth to pick up going forward, and Nifty to deliver 12-15 percent returns in the medium term. Here are edited excerpts of a telephonic interview with Reddy

Quess Corp slumps 12% to hit over 2-year low##Quess Corp slumps 12% to hit over 2-year low

Shares of Quess Corp slumped nearly 12 percent, hitting over two-year low of Rs 460.80. The stock has lost 16 percent in the last six months. So far today, 1.1 million shares of the company have changed hands on the National Stock Exchange, more than five times the daily average volume of 198,446 shares.

UPL up 6% as sentiment improves with monsoon progress##UPL up 6% as sentiment improves with monsoon progress

Shares of agrochemicals maker UPL Ltd surged nearly 6 percent to a high of Rs 690 with investors' sentiment for the company improving due to the progress of monsoon rains. So far in 2019, shares of UPL have gained nearly 36 percent.

SBI hits lifetime high, gains 9% in 11 sessions on recapitalisation hopes##SBI hits lifetime high, gains 9% in 11 sessions on recapitalisation hopes

State Bank of India shares hit their lifetime high of Rs 370.90 on Tuesday, riding on the bank’s recent uptrend amid hopes of recapitalisation of public sector banks in the Union budget. The stock has gained 9 percent in the past 11 sessions and closed on a higher note in 10 of those sessions. Shares of the public sector bank outperformed the Nifty 50 index in the past 30 days as it rose 4.7 percent during the period while the 50-stock index fell 0.6 percent.

Kolte Patil Developers surges as realty firm signs 3 new projects in Pune##Kolte Patil Developers surges as realty firm signs 3 new projects in Pune

Shares of Kolte-Patil Developers traded 5.7 percent higher at Rs 231.70 on NSE at 12.20 pm. The gains as the realty firm disclosed in an exchange filing that it has signed three new projects in Pune under the development management model. The projects are located at Wagholi, Kiwale and Ravet in Pune with a saleable potential of 1.2 million square feet, comprising over 1,250 units to be developed.

Economic Survey 2019: GDP growth predicted at 7% for FY20##Economic Survey 2019: GDP growth predicted at 7% for FY20

The economic survey, prepared by chief economic adviser Krishnamurthy Subramanian, which was tabled in the Parliament by finance minister Nirmala Sitharaman today, has predicted 7 percent GDP growth in the financial year 2020. The economic survey report mentioned stable macroeconomic conditions as the reason behind the higher growth forecast for this fiscal. Huge political mandate augurs well for growth prospects, it noted. READ MORE

Axis Bank gains after CLSA maintains buy rating##Axis Bank gains after CLSA maintains buy rating

Axis Bank shares gained nearly a percent intraday on July 4 after CLSA maintained buy call on the stock saying profit was expected to turn around in FY20. The research house raised price target to Rs 1,000 from Rs 890 earlier, implying 24 percent potential upside. It sees an earnings recovery in FY20 as credit costs normalise. Axis Bank shares have rallied almost 60 percent in last one year.

Tata Steel falls 2.5% as stock trades ex-dividend##Tata Steel falls 2.5% as stock trades ex-dividend

Shares of Tata Steel fell 2.5 percent as the stock traded ex-dividend. The company will pay dividend of Rs 13 per share. This is the highest quantum of dividend payout by the company in 12 years, according to Cogenics. The stock has snapped a three-day rising streak, during which it had gained 1.2 percent. At 10.46 am, shares of the company were flat, down 0.06 percent at Rs 497.

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|