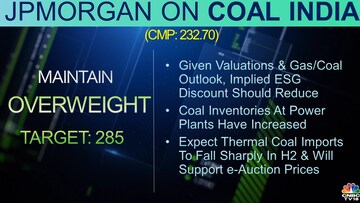

JP Morgan has raised its target price for Coal India Ltd (CIL) to Rs 285, maintaining an overweight stance on the state-run coal behemoth. The target price suggests an upside of more than 20 percent from Wednesday's market levels of around Rs 235.

The global brokerage said that Coal India valuations are attractive amid ebbing ESG concerns. Also, coal inventories at power plants have increased and India's thermal coal imports may fall sharply in the second half of the year. Coal India is expected to benefit from e-auction prices, it further said.

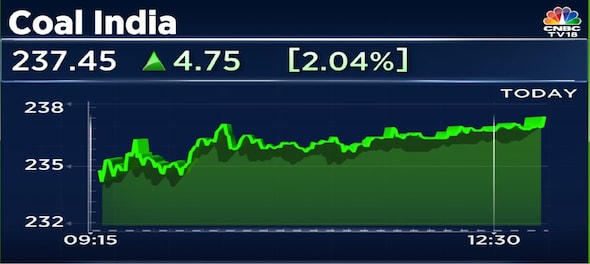

At 12.24 pm, Coal India share price was quoted at Rs 236.85 apiece, up 1.76 percent on BSE, after a flat opening at Rs 232.95 from its previous close of Rs 232.75. The day's high came in at Rs 237.15.

Coal India posted better than estimated financial results for the April to June 2022 quarter, with its profit shooting up 2.7 times. The company’s consolidated net profit shot up 178 percent on a year-on-year basis to Rs 8,834 crore for the first quarter of 2022-23 on higher sales, beating CNBC-TV18 poll projection of Rs 6,301 crore.

After Coal India's April-June quarter results, CLSA had also raised its target price to Rs 250 from Rs 205 per share earlier and maintained a buy rating.

Jefferies, on the other hand, had given Coal India shares a hold rating with a target price of Rs 175 per share.

CIL supplies nearly 80 percent of India's coal requirements, an industry tightly regulated by the government, given its strategic importance to meet energy requirements. In fact, CIL production increased by 44.6 million tonnes (MTs) in just five months and four days of the ongoing fiscal, as of September 4 eclipsing the previous best of 44.5 MTs registered in FY2016, which was for the entire year.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Polls 2024: In battle of legacy, HD Deve Gowda and G Puttaswamy Gowda’s grandsons fight in Hassan

Apr 26, 2024 8:11 AM

Jodhpur Lok Sabha Constituency: It is Gajendra Singh Shekhawat vs Karan Singh Uchiarda

Apr 26, 2024 8:04 AM