Global index aggregator MSCI will be announcing its February 2024 restructuring on Tuesday, February 13, and any changes will be adjusted on February 29, 2024. According to Nuvama Alternative & Quantitative Research, the reshuffling in MSCI's Global Standard Index could lead to passive foreign institutional investor (FPI) inflow of nearly $1 billion into the Indian stock market.

Notable stocks expected to witness addition include Jindal Stainless, likely to receive $112 million inflow, Union Bank with an anticipated inflow of $142 million, and NMDC with $126 million.

Additionally,

Punjab National Bank, BHEL, and Oberoi Realty are also poised to benefit, with PNB securing the highest inflow of $156 million.

BHEL and

Oberoi Realty are expected to likely get an inflow of $155 million and $129 million respectively.

Conversely, Indraprastha Gas Ltd is speculated to face exclusion from the MSCI Standard Index, according to Nuvama report.

Simultaneously, the upcoming

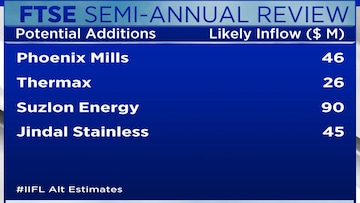

FTSE Semi-Annual Review, scheduled for announcement on February 16, is expected to bring further market adjustments on March 15.

Potential additions to the FTSE index include Phoenix Mills, Thermax, Suzlon, and Jindal Stainless, with anticipated inflows of $46 million, $26 million, $90 million, and $45 million, respectively.

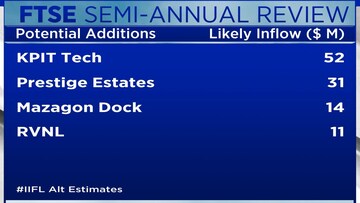

Other stocks under consideration are KIPT Prestige Estates, Mazagon Dock, and RVNL.

Catch our latest updates on markets here