Gaming and sports-media platform Nazara Technologies was one of 2021's most successful IPO. However, shares have more than halved after scaling a peak of Rs 1,678 earlier this year. On a year-to-date basis, Nazara Tech stock price is down nearly 40 percent.

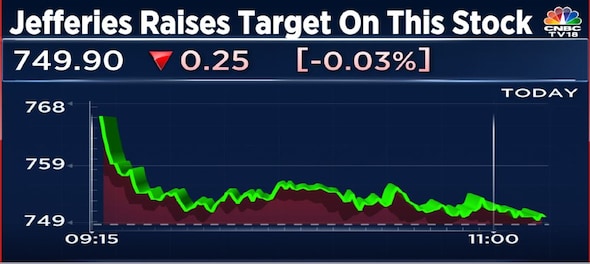

However, Jefferies cites a favourable risk-reward post the correction to raise its price target on the stock to Rs 860 from the earlier target of Rs 780. While the revised target implies a potential upside of 15 percent from Monday's closing levels, it remains well below the stock's 52-week high. The brokerage has maintained its "buy" recommendation on the stock.

Jefferies met the founder and managing director of Nazara, who highlighted that the growth outlook for divisions like Nodwin and Sportskeeda remains strong. Nazara is known for its games in the World Cricket Championship, Chhota Bheem, and the Motu-Patlu series. The late Rakesh Jhunjhunwala also owns a 10 percent stake in the company, which at its current market price is valued at nearly Rs 500 crore.

Nazara had acquired a 55 percent stake in NODWIN Gaming Pvt. Ltd. in 2018 through a cash-and-stock deal. The management said that since the acquisition, NODWIN has diversified from an e-sports event management firm to a company that drives gaming engagement. Through recent acquisitions of Brandscale and Planet Superheroes, the company has forayed into content creation around eSports. The company also plans on utilising Nodwin's balance sheet cash worth Rs 40 crore to build on these initiatives.

The management also expects healthy growth for Sportskeeda to continue over the next few years. As a result, Jefferies has raised Sportskeeda's revenue estimates for FY25/26 by 5-10 percent and expects compounded revenue growth of 47 percent until FY26 for this segment.

Nazara also acquired a 100 percent stake in Wildworks for $10 million last month. Wildworks is a game developer that caters to kids between the age of 8-12. Jefferies expects the acquisition to add $12 million to Nazara's revenue and help solidify its presence in the game field learning segment in the US.

Other key takeaways:

Shares of Nazara Technologies are trading 0.6 percent higher at Rs 750.95 as of 11 AM.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 35% voter turnout recorded by 1 pm

Apr 26, 2024 9:11 AM