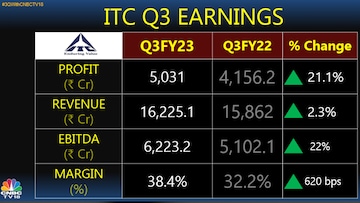

Fast-moving consumer goods (FMCG) major ITC reported a 21.1 percent year-on-year (YoY) jump in net profit at Rs 5,031 crore for the third quarter that ended December 31, 2022.

According to Abneesh Roy, Executive Director of Nuvama Institutional Equities, 2023 will be a good year for ITC, a major player in the FMCG space and that the company will see significant growth and success in the coming years.

With this in mind, Roy recommends investing in ITC and keeping an eye on its progress. He sees a target of Rs 450 per share on ITC.

The consumer products to hotels conglomerate reported a 22 percent increase in earnings before interest, taxes, depreciation, and amortisation (EBITDA) at Rs 6,223.2 crore in the third quarter of this fiscal compared to Rs 5,102.1 crore a year-ago. EBITDA margin stood at 38.4 percent in the reporting quarter compared to 32.2 percent a year ago.

Roy also shared his thoughts on margin recovery for FMCG companies like ITC, Godrej Consumer Products Limited (GCPL) and Britannia Industries.

“We will be positive on ITC, Godrej Consumer, Britannia Industries and Hindustan Unilever Ltd (HUL),” he said.

He also likes paint stocks as he is seeing a recovery in demand in January and February.

“We expect that in quarter four, most of the paint stocks should deliver a high single-digit volume growth and there should be some margin recovery also,” he added.

According to Roy, these companies will see a boost in margins and profitability in the near future, which will make them more attractive to investors. With the right strategies in place, these companies will be able to achieve sustained growth and success in the years to come.

As we enter into a new year, investors and traders are keenly observing the various factors that could impact the stock market. One of the factors that are being closely monitored by market experts is the El Nino phenomenon and its potential impact on the monsoon season.

The monsoon season is crucial for the Indian economy, particularly for the agriculture sector, which is heavily dependent on rainfall. Any adverse impact on the monsoons could have a ripple effect on the stock market.

Roy also touched on the importance of tracking the impact of El Nino on monsoons. This is a critical issue for the FMCG industry, as it can have a major impact on supply chains, crop yields, and overall profitability. As such, it is essential for investors and industry insiders to keep a close eye on weather patterns and other environmental factors that can affect the FMCG sector.

“El Nino is important, it has an inverse relationship with monsoon in India,” he said.

The stock of ITC was up 2.28 percent in the last week and 15.51 percent in the past month.

For more details, watch the accompanying video