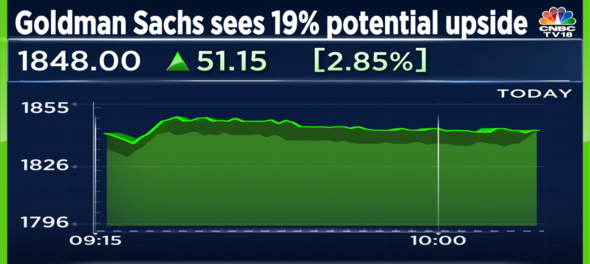

Goldman Sachs has upgraded Interglobe Aviation, which operates IndiGo, India's largest airline by market share, to buy due to "comfortable valuations", among other positive metrics. The brokerage has increased its price target on the stock to Rs 2,210 from Rs 1,990, implying a potential upside of 19 percent from Monday's closing price.

Although catalysts for the near-term are weak due to higher fuel costs, lower yields due to seasonality and an adverse foreign currency impact, Goldman Sachs believes that expectations for a weak September quarter are largely priced in.

With crude prices having witnessed their biggest quarterly drop in over two years, Goldman Sachs believes that the trend will aid the airline's near-to-medium-term profitability.

Here are five other factors:

Sustainable Market Share Gains

IndiGo has consolidated its leadership position further during the pandemic, increasing its market share to 58.8 percent in July this year from 48 percent in February 2020. With smaller airlines like SpiceJet struggling with cost overruns and liquidity challenges, they may end up conceding market share to IndiGo or Air India, which may benefit post the Tata acquisition. Based on the challenges to smaller incumbents, Goldman Sachs expects IndiGo to be well positioned to maintain a 55-60 percent market share over the next two to three years.

Recovery In Demand

Current domestic air traffic is 5-10 percent below pre-Covid levels while international traffic is 30-35 percent lower. Goldman Sachs expects overall air passenger traffic to grow 22 percent in FY24, assuming that international travel returns to pre-covid levels and domestic traffic grows at 10 percent. IndiGo's fleet position keeps them well positioned to cater to the growing demand. The firm expects Airbus to prioritize IndiGo's orders as it is their largest customer with 514 planes to be delivered.

Better pricing Discipline

Airfares in India have inched up once the COVID-related price caps were lifted by the government. Prices have increased in line with crude prices, which had hit multi-year highs during Russia's invasion of Ukraine. Goldman Sachs sees this as a departure from historical trends as prices only increased modestly earlier, even during periods of higher crude prices. It attributes this to airlines trying to recoup earlier losses. Additionally, with market share consolidating towards IndiGo, the airline will likely have further pricing power, at least in the short term. However, the firm does not see ticket prices or yields remaining at elevated levels for very long.

Strong Financial Performance

Goldman Sachs expects IndiGo's revenue to nearly double from FY20 levels over the next two years and its EBITDAR to triple over the same period. Airlines include rent and restructuring costs in their EBITDA, making it EBITDAR. It expects this financial performance to be driven by improvement in traffic, international fleet expansion, better yields, and operating leverage.

Comfortable Valuations

Considering the near-term headwinds and disruptions of higher yields, an evolving competitive landscape, and higher crude prices, Goldman Sachs believes that earnings estimates for the financial year 2025 are a more realistic assumption for the stock. The firm finds valuations of 9.5 times FY25 EV/EBITDAR to be comfortable.

Pricing, fuel prices, and forex rates are the three key variables that Goldman has cited to have a material impact on IndiGo's earnings going forward.

Shares of Interglobe Aviation are trading 2.7 percent higher at Rs 1,845.15, as of 10:10 AM.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM