IT services major Infosys' buyback period cooled off on Wednesday, September 8, 2022. Last year in September, Infosys bought back over 5.58 crore equity shares as part of its around Rs 9,200-crore buyback offer.

Accordingly, there needs to be a one-year gap between when the buyback ends and the next buyback can be announced; now that Infosys buyback cool-off period has ended the company is eligible for another buyback.

When will the buyback happen?

Infosys has a history of announcing buybacks with earnings results, hence the next buyback can be expected to be announced on October 12 when the company will release its earnings report for the third quarter of the financial year 2023.

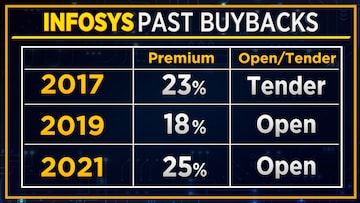

Infosys past buybacks

The buyback will be the fourth by Infosys. In the last buyback, the equity shares were bought back at a volume-weighted average price of Rs 1,648.53 per equity share.

After the buyback, the promoter shareholding has increased to 13.12 percent from 12.95 percent.

What can be expected from the next buyback?

As the last two buybacks by the company were open market buybacks and not tender buybacks, it can be expected that the next one will perhaps also be an open market buyback with no promoter participation.

A

buyback or share repurchase involves a company buying back its shares from its shareholders. Usually, firms repurchase their stock at a premium to the going market rate. In a tender offer, the company offers to buy back its shares at a specific price (the 'offer price'), and shareholders can tender, or sell, their shares, at that price. In an open market offer, the firm has the option to actively purchase shares from sellers on the exchange and repurchase them.

From 2019-20, Infosys enhanced its capital allocation plan and said it will return 85 percent of free cash flow cumulatively over a five-year period via buyback and dividends.

(Edited by : Shoma Bhattacharjee)

The buyback will be the fourth by Infosys. In the last buyback, the equity shares were bought back at a volume-weighted average price of Rs 1,648.53 per equity share.

The buyback will be the fourth by Infosys. In the last buyback, the equity shares were bought back at a volume-weighted average price of Rs 1,648.53 per equity share.