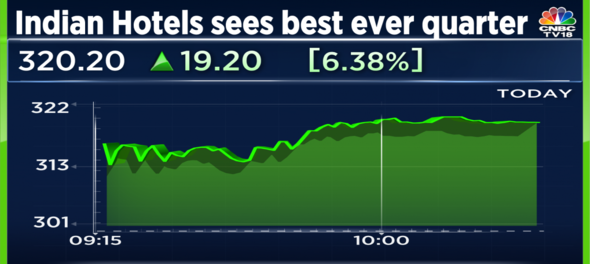

Shares of Indian Hotels are trading with gains of 6.5 percent after the company reported a four-fold rise in consolidated net profit at Rs 403.56 crore in the third quarter ended December 2022 on the back of robust demand.

The company had posted a consolidated net profit of Rs 95.96 crore in the year-ago period, Indian Hotels Company Ltd (IHCL) said in a regulatory filing.

Profitability of the hotels chain was also aided by lower finance costs, higher other income and gains from the sale of land during the quarter.

Indian Hotels termed the results as its best ever quarter.

Consolidated revenue from operations during the quarter under review stood at Rs 1,685.8 crore as against Rs 1,111.22 crore in the corresponding period previous fiscal, it added. Total expenses were higher at Rs 1,248.62 crore in the third quarter, up from Rs 1,014.23 crore a year ago.

Buoyed by a strong demand in the third quarter, both leisure and business hotels in key domestic markets reported occupancy of over 70 percent and a rate growth of 27 percent as compared to pre-COVID levels, the company said.

IHCL managing director and CEO Puneet Chhatwal said the company continued to report strong operational and financial performances across its businesses in Q3 resulting in an all-time high profit after tax.

"Robust demand across markets and segments, including our airline catering has led to all group companies reporting a positive PAT in Q3 across domestic and international operations," company's executive vice president and CFO Giridhar Sanjeevi said.

The revenue performance supported by scale benefits have enabled strong flow-through and record margins, he said, adding, "IHCL continues to report a healthy consolidated free cash flow of Rs 766 crore till date in FY 2022-23 and remains net cash positive."

Chhatwal said IHCL has reached a milestone of over 250 hotels and is in line with its vision of being a 300-hotel portfolio by 2025.

"In this financial year alone 30-plus hotels have been added to the pipeline and 14 hotels have opened, besides a strong growth in amã Stays & Trails with 108 homestays and Qmin with over 25 outlets," Chhatwal added.

The demand outlook for the sector in 2023 remains robust on the back of sporting events such as world cup hockey and cricket, global events like the ongoing G20 and recovery of inbound and corporate travel, he said.

"IHCL with its vast network of hotels spread across over 125 cities is well positioned to cater to this rising demand," Chhatwal said.

Shares of Indian Hotels are trading 6.4 percent higher at Rs 320.4. The stock is up for the third straight day.

First Published: Jan 31, 2023 7:46 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Election Commission grants shifting of 7 polling stations in Kullu, Mandi, Shimla and Kinnaur

May 5, 2024 6:50 PM

Tents, fans, ambulances – Karnataka gears up for voting on May 7 amid soaring heat

May 5, 2024 6:19 PM

Karnataka Congress files complaint against BJP’s JP Nadda and others over alleged MCC violation

May 5, 2024 3:20 PM

PM Modi to contest from Varanasi, to file nomination papers on May 14

May 5, 2024 2:49 PM