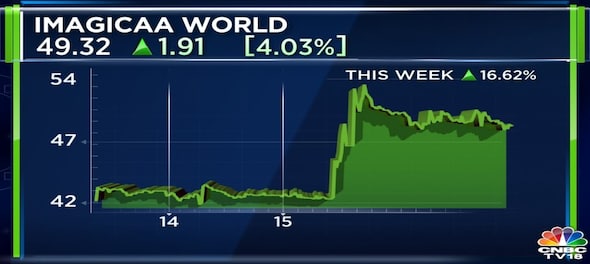

Shares of Mumbai-based theme park and entertainment company, Imagicaaworld Entertainment have climbed nearly 15 percent over the last 2 days. The spike started on Wednesday, when the stock rose 10 percent after the company announced it had received approvals to write-off debt to the tune of Rs 571.76 crores. The stock rallied a further 4 percent on Thursday.

The write-off is part of a debt resolution plan entered into by Malpani Parks and Aditya Birla ARC (Asset Reconstruction Company) a year ago in June 2022. “As the residual leg of the resolution plan, we have now written back remaining debt of Rs 571.76 crores which will reflect in our balance sheet and show the true picture as on date,” said Malpani Parks’ MD Jai Malpani. The Malpani Group had acquired a majority 66.25 percent stake in ImagicaaWorld in June 2022 through a preferential allotment of shares aggregating Rs 415 crores.

The write-off comes as good news for investors as it removes a year-long overhang over the company regarding legacy debt, and allows the management to embark on expansion plans. Malpani added, “We aim to solidify our position as a leader in the entertainment park industry, known for pushing the boundaries of entertainment.”

Shares of the company closed Thursday’s trading session at Rs 49.20 per share.

(Edited by : Keshav Singh Chundawat)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM