The Indian capital goods sector offers promise for investors, as per brokerage firm IIFL. Companies such as Cummins, KEC International, and MTAR Tech are expected to continue to perform well, while the capital expenditure cycle is showing positive signs.

The latest earnings season has also been encouraging for capital goods players, with sharp margin expansion reported in the last quarter. This is a positive sign for investors, indicating that the companies in this sector are managing costs well and delivering strong returns.

“Cummins has been our top pick for the last two years,” said Renu Baid of IIFL Institutional Equities in an interview with CNBC-TV18.

“Earnings have been upgraded but the recommendation was always a ‘buy’,” she added.

The leading provider of power solutions has been a consistent performer, which has earned it the top spot in the investment firm's portfolio for the last two years. Baid is confident that Cummins will continue to perform well in the coming years.

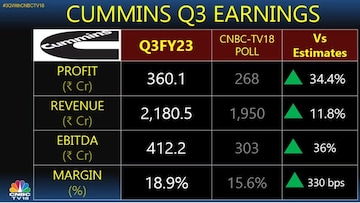

The Pune-based Cummins group company, reported nearly 50 percent year-on-year growth in net profit at Rs 360.41 crore for

the December quarter, beating the CNBC-TV18 poll estimates of Rs 268 crore.

Its revenue at Rs 2,180.5 crore in the third quarter of FY23 was also 11.8 percent higher than the poll estimate.

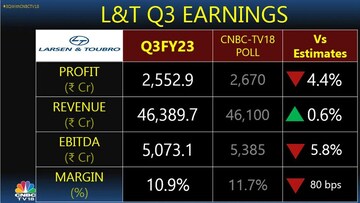

“Apart from Cummins, the top pick would also be Larsen and Toubro (L&T) in the largecap space. And midcaps – probably names like KEC International will start to look better or MTAR Technologies,” she mentioned.

Engineering and construction company

KEC International had reported an 81.2 percent fall in its quarterly profit, affected by elevated costs. The company’s consolidated profit stood at Rs 17.6 crore for the quarter ended December 2022, against a profit of Rs 93.6 crore in the year-ago period. The sub-contracting expenses soared 55 percent and cost of materials consumed increased 27 percent leading to a total increase of 35 percent.

IIFL believes that the Indian economy has been showing signs of a strong recovery, and there are greenshoots in the capital expenditure (capex) cycle, which are sustaining well.

Price hikes were taken in the last quarter, which could further boost margins for capital goods companies. However, Baid warns that investors should expect some tapering of margins in quarter four, as companies may face headwinds from rising input costs.

Despite the strong performance of the capital goods sector, some companies are trading at a higher end of valuation multiples. ABB is one such company, which is currently trading at a premium valuation. However, Renu Baid believes that the high valuation is a result of the company's expected growth and potential for future success.

Baid also likes ABB India and Siemens.

“We also like ABB India and Siemens but valuations are sticky, so for fresh buys from these levels, we will hold on. We will prefer to add if the stocks consolidate,” she said.

Global technology company

ABB India reported a 62.3 percent year-on-year (YoY) jump in net profit at Rs 305.3 crore for the fourth quarter that ended December 31, 2022.

For more details, watch the accompanying video