Large cap stocks typically lead the mid and small cap stocks in a bull market, but the current rally depicts a different picture. ‘Liquidity’ seems to be most-cited argument among investors about the rally in smaller names, which largely reflects bullish sentiment among domestic institutional and retail investors.

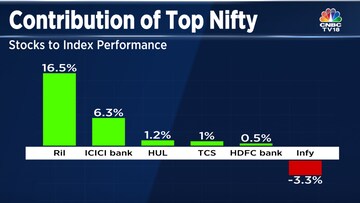

The muted performance of several large cap stocks in the past 3 months has been a drag on the overall market performance. Nifty is up 9 percent, but most top Nifty 50 stocks clocked meagre returns.

Banking giants- HDFC Bank and ICICI bank clocked 0 percent and 6 percent returns respectively, while two largest Indian IT services firms have delivered 1 percent and negative 6 percent returns respectively in the past 3 months. Heavy weights- Reliance and HUL have clocked 18 percent and 5 percent returns respectively in the same period. Hence, their contribution to index growth has been limited.

Note: Data for past 3 months; Source: Kotak Institutional Equities

Note: Data for past 3 months; Source: Kotak Institutional EquitiesIn June 2023, small cap funds remained investors' favourite with inflows of Rs 5,472 crore. According to Mukesh Kochar, National Head-Wealth at AUM Capital Market, the primary reason for strong inflows in small-cap funds could be the valuation gap between small-cap companies and large-cap companies.

"This always happens when markets become a little expensive but the fund flow chases stocks. In such type of market, fund managers try to find out values or pockets of opportunities on a comparable basis that are available at the lower end of the radar. These stocks are with a low base and can grow at a higher pace compared to large companies in terms of percentage growth and are undiscovered stories. Hence, higher risk and higher reward. The massive fund flow via mutual funds, PMS or direct equity investors has added more momentum to it," Kochar said.

Valuations are expensive in India and is a natural headwind for the market, says Kotak Institutional Equities. Nifty 50 index is up 11 percent, Nifty 100 Midcap 100 Index is up 17 percent and Nifty Smallcap 100 index is up 19 percent in the past four months.

Are large caps a laggard in US too?

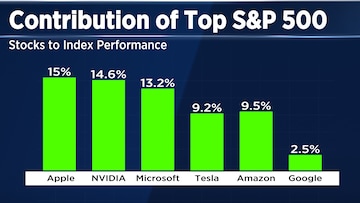

In contrary to Indian equities market, mega-cap stocks are the leaders in a slowing economy in the US. However, it needs to be seen if this mega stocks rally, primarily led by 6-8 technology-oriented stocks in US sustains.

The tech stocks have performed on expectations of them dominating the emerging AI space. Kotak Institutional Equities says the AI-driven rally is hard to sustain if high interest rates stay for an extended period of time. In an attempt to tame demand and inflation, there is a likelihood of an eventual slowdown in household consumption when the ongoing tight labor markets and excess household financial saving, supporting household spending fade.

Note: Data for past 3 months; Source: Kotak Institutional Equities

On July 11, Nifty closed the trading session with gains capped at less than 0.5 percent, led by the financials sector witnessing a fall in the last hour of trade.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!