Shares of ICICI Bank may rise to as much as ₹1,350 apiece in the next one year, according to analysts at the top broking firms. The increase in consensus price targets has come after the country's second largest lender reported 35.8% rise in net profit at ₹10,261 crore for the June to September quarter, compared to the same time last year.

On Monday (October 23), the shares of ICICI bank were the second biggest gainers on the Nifty 50, the index of India's blue chip stocks.

Here's a look at how different brokerage houses are seeing ICICI Bank's numbers:

CLSA

The brokerage has issued a 'Buy Call' on ICICI Bank with a target of ₹1,225 per share. The bank's performance in Q2 was strong, and despite the fall in net interest margin (compared to three months ag) as well as the rising competition for low-cost deposits, the stock is 'reasonably' valued, according to the analysts.

"The Return on Equity (RoE) remains steady, and there are no significant concerns regarding unsecured loans," the firm said. "ICICI Bank's run-rate Return on Assets (RoA) of 2.2% and return on equity of 18% are considered best-in-class in its peer group," it added.

Return on equity is calculated by dividing net income by total shareholders' equity. It measures how efficiently the capital is being used. The bank's net income divided by the average of its total assets, and expressed in percentage, is the return on assets, a measure of the bank's profitability.

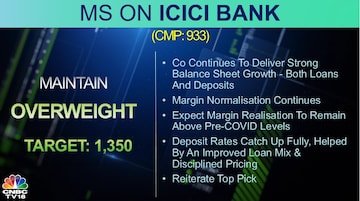

Morgan Stanley (MS)

The brokerage has recommended an 'overweight rating' for ICICI Bank with a target of ₹1,350 per share.

The bank is giving out more loans than the deposits it's taking in. That means better profit for the shareholders. For the September quarter, ICICI Bank's retail loan portfolio grew by 21.4% year-on-year. On the other hand, deposits grew 18.8%. More than half (54.3%) of all loans given by ICICI Bank fall in the retail category i.e. the borrowers are individuals.

Even though the net interest margin for the bank is shrinking, it will be higher than the pre-pandemic levels, according to the brokerage. "Deposit rates have caught up, partly due to an improved loan mix and disciplined pricing," it noted.

Bernstein

Here, the target price is at ₹1,050 per share on ICICI Bank. That's about a hundred bucks more than the current price of the stock. The fall in credit costs helped offset the margin squeeze, the analysts said.

Jefferies

The brokerage gave a 'buy call' on ICICI Bank with a target of ₹1,250 per share. "Better loan growth contributed to the topline, and credit costs were low. The bank's management expressed confidence in the quality of retail unsecured loans," said the report, which also projected that pressure on margin will ease over the next two quarters.

Nuvama

This Mumbai-based brokerage was a little disappointed by both the margin as well as the topline i.e. the net interest income reported by ICICI Bank in the September quarter. However, the bank's profit after tax (PAT) beat Nuvama's estimate by 8%, thanks to a significant decrease in credit costs.

That led Nuvama to raise its earnings estimate by 9% for the current financial year ending March 2024, and by 2% for the next 12 months. The target price for the stock in this case is ₹1,180.

(Edited by : Sriram Iyer)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: All about Congress candidates

May 8, 2024 2:11 PM

Finance Minister calls Sam Pitroda 'racist' — here's the full statement and reactions from BJP leaders

May 8, 2024 1:28 PM

PM Modi's 'Apni Kashi' set for massive 5km, 4-hour-long road show on May 13

May 8, 2024 11:25 AM