FY23 was a quiet year for the Indian equity markets. However, it was a stock picker's market as some stocks moved by 20-50 percent.

In FY23 the Indian markets were faced with many challenges; First, was interest rate hikes globally. Second, high valuations in Indian equity markets and third, the China reopening trade which took away some part of fund flows. Also foreign institutional investors (FIIs) sold the Indian equities for majority of the fiscal and towards the end of the year the US banking crisis put the markets in bit of a tizzy.

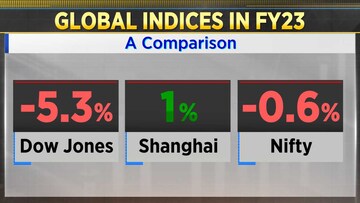

Compared to global indices the Nifty was down only 0.6 percent but the pain was in the small cap index which was down by 14 percent. However Nifty bank and the midcap index ended with gains of 11 and 1.4 percent respectively.

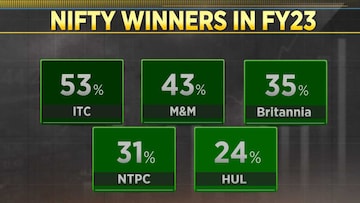

On a stock specific basis in Nifty 50, ITC gained by 53 percent, M&M gained 43 percent, while Britannia, NTPC and HUL gained between 35 and 24 percent.

On the losing side, Wipro was down by 39 percent, Divi's Lab was down 36 percent, while Hindalco, Tech Mahindra, Bajaj Finserv, Infosys, Tata Steel and Adani Ports were down between 29 and 18 percent.

From the broader markets, Gland Pharma was down 62 percent, Laurus Labs was down 50 percent, Trident and Mphasis was down 47 percent, while Vodafone-Idea, Biocon and Godrej Properties were down between 39 and 38 percent.

However there were some big gainers as well. Stocks like Indian Bank, TVS Motors, Union Bank and Apollo Tyres gained between 89 and 68 percent.

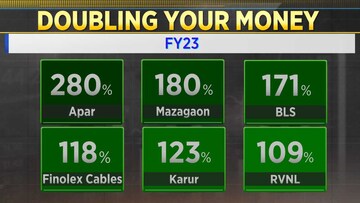

Some of the money doubling stocks included Apar Industries which gained by 280 percent, Mazgaon Dock gained by 180 percent and BLS International gained by 171 percent.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: 28% of candidates contesting in fourth phase are 'crorepatis'

May 9, 2024 4:29 PM

Free poha-jalebi to movie ticket discounts: How cities struggling with 'urban apathy' are luring voters to polling booths

May 9, 2024 3:17 PM