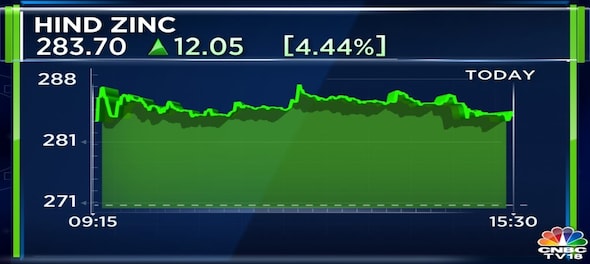

A day after Hindustan Zinc (HZL) announced an interim dividend of Rs 21 per equity share for its shareholders, the miner's shares hit an intraday high of Rs 288, going up by 5.94 percent on BSE, before settling at Rs 283.65.

Vedanta Group firm HZL in a filing to BSE on Wednesday said the board had approved an interim dividend of 1050 percent on the face value of Rs 2 per share for the financial year 2022-23.

The biggest chunk of the Rs 8,873.17 crore dividend will go to the government of India, which has a 29.5 percent stake in the miner. Anil Agarwal-led Vedanta has a 64.9 percent stake. Last week, the Centre sought bids from merchant bankers to assist it in offloading its 29.5 per cent stake in the company. The plan was to sell the stake in the open market in tranches.

A few days ago the miner reported a 14 percent rise in metal production during the first quarter of the financial year 2023. The dividend has been made possible as the business is generating enough cash.

According to Asif Iqbal of Choice Equity Broking, Hindustan Zinc has been giving dividends for two years. Analysts expect another dividend of Rs 20 from the miner this year. According to Iqbal, in this context, Hindustan Zinc’s dividend yield works out to 14 percent.

"In such a situation, investors can find more benefits than fixed deposits (FD) in these dividend yield stocks. The government holds about 30 percent stake in Hindustan Zinc. Hence, a good dividend is expected in the future as well," he said.

What is dividend yield

Dividend yield means if a share is trading at Rs 100 and the company has declared a dividend of Rs 6 then its dividend yield is 6 percent as compared to the share price. Dividends are tax-free cash pay-outs. The higher the dividend yield on a stock, the better the stock.

Currently, the stock market is in a downtrend. Small investors cannot track the market. In such a situation, investors can take advantage of companies with good fundamentals. Such companies pay regular dividends. These companies have strong cash flow, but also high operating profit margins. They maintain good revenue growth even when the economy is in awful shape. For these reasons, the valuations of such stocks are also often high.

Iqbal said that when bears dominate the market, investors should change their portfolios. "In such a situation, investors should bet on high dividend yield stocks (good dividend payers), as these give benefits to the investors in two ways. One, the fundamentals of companies are good, which often give good returns. With better dividends, they further increase the profits of the portfolio," Iqbal said.

What is ex-dividend

Ex-dividend describes a stock that is trading without the value of the next dividend payment. For example, if a company with a share of Rs 335 rupees declares a dividend of RS 5, on the ex-dividend date, the share price may fall to Rs 330, as the company no longer has these Rs 5.

The ex-dividend date is usually two business days before the record date. This happens because in India the settlement takes place on a T+2 basis, i.e. two days after the transaction. So, if one wants dividend they would have to buy the share before the ex-dividend date.

Dividend pay-out day is when the dividend is paid to the shareholders. Shares till the ex-dividend date are called the cum dividend.

Information for shareholders

The record date for the purpose of payment of interim is Thursday, July 21.

Meanwhile, on Thursday, the miner of metals and other metals said it had created a shareholders portal on its website under the tab 'investors' where those desiring to have lower or no TDS deducted from the interim dividend for the financial year 2023 should upload requisite documents by July 22 by 5.00 pm.

"Any document received for lower tax deduction after July 22 will not be considered," the company said in an exchange filing.

(Edited by : Shoma Bhattacharjee)

First Published: Jul 13, 2022 6:12 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: 28% of candidates contesting in fourth phase are 'crorepatis'

May 9, 2024 4:29 PM

Free poha-jalebi to movie ticket discounts: How cities struggling with 'urban apathy' are luring voters to polling booths

May 9, 2024 3:17 PM