Brokerage houses have kept target price in between Rs 1,800-Rs 2,300 on HDFC Bank a day after the lender re-appointed Sashidhar Jagdishan as the Managing Director and Chief Executive Officer of the bank. The lender's shares on Wednesday, September 20, declined nearly 4 percent in early trade on the Bombay Stock Exchange (BSE).

The brokerage firms have weighed in on the lender's recent developments and mergers, offering both positive and cautionary insights.

Here's what key brokerage houses said on HDFC Bank:

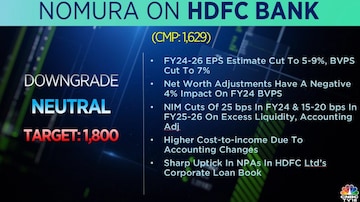

Nomura

Brokerage firm Nomura has downgraded HDFC Bank's rating to neutral from its earlier rating of buy. It has cut the price target to Rs 1,800 from Rs 1,970 earlier.

It has cited four negative surprises after the mega HDFC Bank-HDFC merger behind its downgrade.

(1) Net worth adjustments have a negative 4 percent impact on FY24F BVPS (book value per share).

(2) Net interest margin (NIM) cuts of about 25 bps in FY24F and 15-20 bps in FY25-26F on excess liquidity, and accounting adjustments.

(3) Higher cost-to-income due to accounting changes (upfronting of sourcing costs under IGAAP for HDFC versus amortisation under IndAS).

(4) A sharp uptick in non-performing assets (NPA) in HDFC’s corporate loan book.

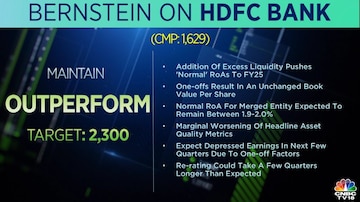

Bernstein

Bernstein has kept the target price at Rs 2,300 for the lender. The brokerage's analysis of HDFC Bank further reveals that the addition of excess liquidity is pushing 'normal' Return on Assets (RoAs) to FY25.

"However, one-off factors have resulted in an unchanged book value per share. The forecasted normal RoA of the merged entity remains at 1.9-2.0 percent. Nevertheless, there is a slight concern about a marginal worsening of headline asset quality metrics," it said.

The anticipation of depressed earnings in the next few quarters, due to these one-off factors, has suggested that the normalisation of RoA and subsequent re-rating may take a few quarters longer than initially expected, the brokerage said.

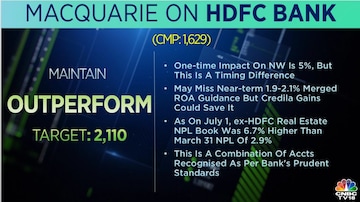

Macquarie

The brokerage has kept the target price at Rs 2,110 while presenting a mixed perspective. It has acknowledged some negative surprises in the merged numbers, highlighting a one-time impact on net worth amounting to 5 percent, though this is attributed to timing differences.

There's a possibility of missing the near-term 1.9-2.1 percent merged Return on Assets (ROA) guidance. However, hopes are pinned on potential gains from Credila, the education loan unit, the firm said.

CITI

CITI has cut the target price to Rs 2,110 while expressing surprise at e-HDFC's non-individual non-performing assets (NPAs) rising from 3.7 percent in March 2023 to 6.7 percent in June 2023. Additionally, it has noted a Specific Provision Coverage Ratio (PCR) exceeding 70 percent on HDFC's NPA, along with a 0.7 percent contingent provision on the overall portfolio.

"There's a significant rebasing of Net Interest Margins (NIMs) to 2.9 percent for FY23, coupled with further reductions on merger day. These factors have a notable impact on e-HDFC's March 2023 Ind-AS net worth," the firm said.

UBS

The brokerage has kept the target price at Rs 1,900, while emphasising the need for clarity on the merged balance sheet and points out a slightly weaker Book Value per Share (BVPS). Accounting and provision adjustments are seen to have reduced net worth accretion, with the creation of a Deferred Tax Liability (DTL) reserve expected to impact capital ratios. The first-quarter Net Interest Margins (NIMs) are anticipated to be influenced by the Indian Corporate Rupee Reserve (ICRR) and excess liquidity, UBS said.

Jefferies

The brokerage has kept the target price at Rs 2,030. It recently hosted an analyst meeting to clarify the transition impact of the merger with HDFC. It has anticipated a slightly higher impact on NIMs due to increased liquidity and ICRR. Reports also suggest that the non-performing loans of HDFC Ltd are currently higher. Despite a 5 percent net worth impact, most of it is categorised as non-cash and transitional, and retail deposit mobilisation remains stable, it said.

Morgan Stanley

The firm has kept the target price at Rs 2,110. It highlighted lower Book Value per Share (BVPS) and earnings estimates for HDFC Bank. This adjustment is attributed to one-time net worth/PnL adjustments as HDFC transitions from IND-AS to Indian GAAP accounting.

Additionally, lower net interest margins (NIMs) are expected, largely due to the influence of I-CRR/excess liquidity and heightened competitive intensity, the firm said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM

Election Commission grants shifting of 7 polling stations in Kullu, Mandi, Shimla and Kinnaur

May 5, 2024 6:50 PM