Brokerage houses were mostly optimistic about HDFC Asset Management Company (AMC) a day after the firm announced financial results for the quarter that ended December 31, 2023. The firm reported a consolidated net profit of ₹488 crore, marking a 32.2% year-on-year (YoY) increase from ₹369.2 crore in the corresponding quarter last financial year.

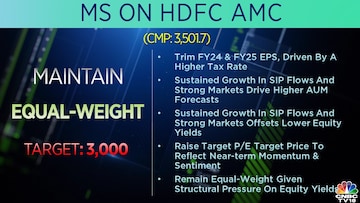

While Morgan Stanley (MS) kept the target price at ₹3,000 per share with an equal-weight call, HSBC kept it at ₹3,410 per share with a 'hold call'.

MS emphasised sustained growth in Systematic Investment Plan (SIP) flows and resilient markets, contributing to higher Assets Under Management (AUM) forecasts.

While acknowledging a higher tax rate impacting earnings, MS remained optimistic about near-term momentum and sentiment.

The brokerage trimmed earnings per share (EPS) projections for FY24 and FY25.

HSBC, on the other hand, highlighted the company's healthy operating performance in Q3FY24, attributing it to market share gains and strong industry tailwinds.

Despite acknowledging potential challenges with income yields in FY25-26, HSBC anticipates slower earnings per share (EPS) growth compared to Assets Under Management (AUM) growth, forecasting an EPS compound annual growth rate (CAGR) of 9% and an average Return on Equity (RoE) of 28% over FY25/26.

Meanwhile, the AMC closed the quarter with ₹5.75 lakh crore in Assets Under Management (AUM). The Quarterly Average Assets Under Management (QAAUM) reached ₹5.51 lakh crore, reflecting an 11.2% market share in the mutual fund industry.

Operating profit from the core asset management business surged by 25% to ₹496.1 crore.

Total investments amounted to ₹6,469.5 crore as of December 31, 2023, with 90% allocated to mutual funds, 6.1% in debentures and tax-free bonds, and 3% in Alternative Investment Funds (AIFs) and other equities.

HDFC AMC showcased a diversified investment portfolio, with 90% in liquid and debt funds, 7.7% in equity-oriented funds, and the remaining in arbitrage funds.

Total live accounts stood at 149 lakh as of December 31, 2023.

Unique customers as identified by Permanent Account Number (PAN) or PAN-exempt KYC Reference Number (PEKRN) now stand at 87 lakh as of December 31, 2023.

At the time of writing this report, the shares of HDFC AMC were trading 1.55% lower at ₹3447.80 apiece on BSE.

(Edited by : Amrita)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: All about Congress candidates

May 8, 2024 2:11 PM

Finance Minister calls Sam Pitroda 'racist' — here's the full statement and reactions from BJP leaders

May 8, 2024 1:28 PM

PM Modi's 'Apni Kashi' set for massive 5km, 4-hour-long road show on May 13

May 8, 2024 11:25 AM