As the Omicron variant of COVID-19 looms large on Dalal Street, unlock theme stocks are once again in the spotlight. Is it an opportune time for investors to pick stocks to play the economic recovery now?

Those who missed the nearly one-sided, liquidity-powered run in the market over the past 12-18 months or so can certainly take advantage of the ensuing market correction. That is the message from Trideep Bhattacharya, CO-CIO-Equities at Edelweiss AMC.

"The re-opening theme is in the final stages of playing out, as of now. However, this is an evolving situation. If we see more lockdowns driven by a third wave of the pandemic, we will re-evaluate the situation," he said in an interview to CNBCTV18.com.

Bhattacharya believes the economic recovery is still in a nascent stage, and buoyant recovery can be expected over the next 2-3 years.

India's GDP expanded 8.4 percent in the September quarter, exceeding economists' estimates, after a growth of 20.1 percent in the previous three months.

"The structural reforms by the government over the last 2-3 years could potentially increase India’s GDP growth by a percentage point or two over the medium term," said Bhattacharya, banking on the country's economic growth story.

ALSO READ

Sectors to focus on now

The veteran money manager is bullish on economy-facing sectors, including select financial and industrial stocks. He is also positive on indirect plays on real estate. On the contrary, his less favourite spaces at the moment include consumer staples and utilities.

He expects volatility to continue in the market over the short term but remains optimistic from a medium-term perspective citing expectations of the capex cycle, structural reforms and the government's growth schemes.

"We believe India could witness a strong capex cycle over the next 2-3 years, something we haven't seen since demonetisation times based on our analysis of capex intentions of the corporate sector and the decade-low interest rates," said Bhattacharya of Edelweiss Group's asset management unit, which manages assets to the tune of over $10 billion across alternative and traditional mutual funds.

So what should investors do now to make the most of the correction on Dalal Street?

The veteran money manager suggests investors be cautious with surplus cash now but keep their analysis ready in terms of sectors, stocks or funds.

"We have seen the rise of direct investing in a major way in recent times and such investors have seen unidirectional markets over the last 12-18 months. With a valuation at current levels, it is probably time to increase allocation towards mutual funds and let experts take the onus of investment decisions on behalf of investors in such volatile environment," he said.

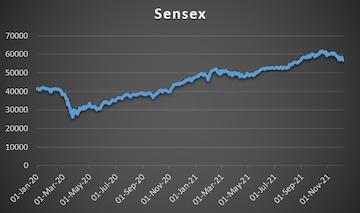

Headline indices have rewarded investors with phenomenal returns in the past year, with the Nifty50 benchmark up almost 27 percent. More than 40 of the index's constituents are positive on a year-to-date basis.

Asked whether valuations at the current juncture are priced in, he said: "We think that the valuation gap that existed between large-cap and mid-cap, and small-cap stocks, about 12-18 months ago has largely closed." Going forward, he expects the movements in the market to be stock-specific.

"They will follow the earnings upgrade/downgrade cycle of stocks closely," he said.

Here are some of the top performers in the Nifty50 pack in the past year:

| Stock | Return (%) |

| Tata Motors | 161.8 |

| Bajaj Finserv | 89.8 |

| Tata Steel | 86.6 |

| JSW Steel | 80.6 |

| Grasim | 79 |

| SBI | 76.8 |

| Wipro | 76.4 |

| Hindalco | 75.5 |

| Tech Mahindra | 67 |

| Titan | 66.7 |

| ONGC | 59.4 |

A similar trend is seen in the BSE 500 pack, with more than 80 percent of its constituents in positive territory.

| Stock | Return (%) |

| Trident | 393 |

| JSW Energy | 354.1 |

| Adani Gas | 349.2 |

| KPIT Tech | 337.8 |

| Adani Transmission | 325.4 |

| Happiest Minds | 295.2 |

| Adani Enterprises | 266.5 |

| HFCL | 257.4 |

| IEX | 241 |

| Persistent | 241 |

Bhattacharya has a selective approach to IPOs in general, and new-age companies in particular.

"We think the key to making money in such business models will lie in the deep insight on which of these companies will eventually emerge as dominant players in the next 5-10 years. In other words, as quite a few such companies get listed in 2021, we have to find the future Google and Amazon and separate them from Yahoo and AOL's that will likely fall along the way," he said.

"We have seen a few such companies in the West. India is just joining the party on the same," he added.

What about the best modes to invest in the market now?

Bhattacharya thinks it's "probably time to increase the allocation towards MFs" given the current valuation levels.

Let experts make the best investment decisions on behalf of investors in the current volatile environment. SIPs also remain another effective way of investing as they smoothen out volatility in equities, he said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM