Foreign investors have been net offloading Indian equities for the past several weeks. The dumping of Indian shares by foreign portfolio investors (FPIs) has been one of the reasons behind the recent correction on Dalal Street.

In December, they net sold stocks worth Rs 19,026 crore ($2.5 billion), a third straight month of foreign fund outflows, provisional exchange data shows.

This is the first time since late 2016 when they took out funds from the Indian equities for three months in a row. In October 2021, FPIs were net sellers to the tune of Rs 13,550 crore, and Rs 5,945 crore in the following month.

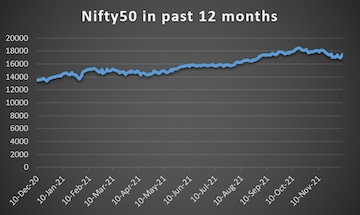

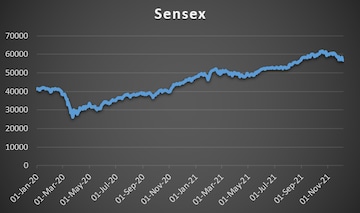

The Nifty50 gained 24 percent in 2021, even when it has retreated 6.7 percent from its all-time high. The breather since the peak in October comes after a nearly one-sided, liquidity-driven rally in the Indian market that lasted some 18 months.

Here's what monthly fund flow into Indian equities has been like in the recent past:

| Month | Net investment | |

| Crore rupees | Million dollars | |

| January '21 | 19,473 | 2,658 |

| February '21 | 25,787 | 3,539 |

| March '21 | 10,482 | 1,444 |

| April '21 | -9,659 | -1,294 |

| May '21 | -2,954 | -389 |

| June '21 | 17,215 | 2,361 |

| July '21 | -11,308 | -1,513 |

| August '21 | 2,083 | 284 |

| September '21 | 13,154 | 1,792 |

| October '21 | -13,550 | -1,807 |

| November '21 | -5,945 | -790 |

| December '21 | -19,026 | -2,525 |

| Total 2021 | 28,422 | 4,107 |

| January '20 | 12,123 | 1,708 |

| February '20 | 1,820 | 265 |

| March '20 | -61,973 | -8,348 |

| April '20 | -6,884 | -904 |

| May '20 | 14,569 | 1,929 |

| June '20 | 21,832 | 2,890 |

| July '20 | 7,563 | 1,018 |

| August '20 | 47,080 | 6,294 |

| September '20 | -7,783 | -1,052 |

| October '20 | 19,541 | 2,661 |

| November '20 | 60,358 | 8,132 |

| December '20 | 62,016 | 8,420 |

| Total 2020 | 1,70,262 | 23,013 |

FII flow in past five years

| Year | Net investment | |

| Crore rupees | Million dollars | |

| 2021 | 25,752 | 3,760 |

| 2020 | 1,70,262 | 23,013 |

| 2019 | 1,01,122 | 14,367 |

| 2018 | -33,014 | -4,390 |

| 2017 | 51,252 | 7,768 |

| 2016 | 20,568 | 3,168 |

Many foreign brokerages have flagged valuations in India as expensive after the rally from the pandemic lows.

City has maintained its view that there is limited upside in the Nifty in the next 12 months. It has given a target of 17,500 for the index for December 2022. India's valuations on absolute terms as well as relative to emerging markets are well above mean, according to Citi.

After the big upgrade cycle in Q3 and Q4, the consensus estimates have been unchanged, it said.

Market veteran Nilesh Shah said in an interview to CNBC-TV18 that he believes India’s long-term growth story is “still very good”. He also said that valuations in the market appear to be fairly priced at the current juncture. His remarks come at a time when headline indices have halted their nearly one-sided, 18-month-long rally.

“Right now valuations are fair. It’s neither expensive like they were in 2008 beginning nor cheap like they were in March 2020. They are fairly priced. If there is a correction in the market because of various events, increase equity allocation. If there is a rally in the market, book some profit,” he said.

ALSO READ: Sky-high valuations? First Global’s Shankar Sharma explains what new-age businesses will have to do

In October, Morgan Stanley downgraded Indian equities to 'equal-weight' from 'overweight' citing expensive valuations. That followed similar moves by Nomura and UBS over expensive valuations.

Yet, some experts remain positive on the market on the valuation front.

Market veteran Nilesh Shah believes India’s long-term growth story is “still very good”. Valuations in the market appear to be fairly priced at the current juncture, he told CNBC-TV18.

“Right now valuations are fair. It’s neither expensive like they were in 2008 beginning nor cheap like they were in March 2020. They are fairly priced. If there is a correction in the market because of various events, increase equity allocation. If there is a rally in the market, book some profit,” said Shah, Group President and Managing Director at Kotak Mahindra AMC.

In the past, the last months of a calendar year have often led to foreign fund outflow in India.

White Oak Capital Management's Aashish Somaiyaa is of the view that FIIs are still constructive about the Indian market. “People do think, seasonally, that everybody is on holiday in the Western world, etc. In fact, there have been many instances where FIIs have had significant flows in the months of November and December. So our sense is nothing to be taken for granted," he said.

Somaiyaa said he wouldn't be surprised if things start to reverse towards the fag-end. He believes India's fundamentals are relatively solid.

First Published: Dec 9, 2021 4:07 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM