In August, MSCI, one of the leading global index providers, announced a list of stocks to be added to its MSCI Global Standard index. These changes are set to take effect in the upcoming (August 31) trading session, bringing with them a wave of anticipation and excitement for the Indian stock market. This inclusion marks a substantial net inflow event for India, with nearly $1 billion of investments expected to pour into the country during the next trading session.

Several prominent Indian stocks are poised to be greatly influenced by this move. Here's a glimpse of the anticipated impacts on some key players:

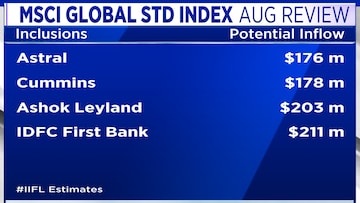

Astral: The stock is expected to see potential inflows of approximately $176 million.

Cummins India: A significant inflow of around $178 million is projected for the stock.

Ashok Leyland: With expected inflows of $203 million, Ashok Leyland is another stock which should be on the radar of investors.

IDFC First Bank: The bank's stock is also likely to experience inflow of $211 million.

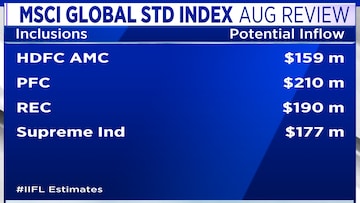

Other noteworthy stocks that are expected to see increased

inflows include HDFC AMC, PFC, REC, and Supreme Industries.

While many stocks are set to benefit from their inclusion in the

MSCI Global Standard index, ACC faces a different fate. ACC is slated to be removed from the index, potentially leading to an outflow of $98 million.

The impact of MSCI's review extends beyond the Global Standard index. The MSCI India Domestic Smallcap Index is also in for some changes. This particular review is expected to bring about 41 new inclusions and removal of 2 stocks.

Interestingly, MSCI has chosen not to make any changes to the Adani group stocks in this review. Instead, they have deferred these changes to the next review.